13 Group 12

Managers: Julie Luftglas, Priel Zimberg, and Thiago Molon

13.1 The setup

p12_list <- c("VALE3.SA", "PETR3.SA", "CSAN3.SA", "ABEV3.SA", "RENT3.SA", "LREN3.SA", "RADL3.SA", "HYPE3.SA", "MDIA3.SA", "BRFS3.SA", "TOTS3.SA", "SQIA3.SA", "WEGE3.SA", "RAIL3.SA", "SBSP3.SA", "EGIE3.SA", "CCRO3.SA", "ENEV3.SA", "STBP3.SA", "ITUB4.SA","BBAS3.SA", "SANB11.SA", "B3SA3.SA")

p12_w <- c("0.1432610332" , "0.0099774435" , "0.0030409937" , "0.0345260994" ,"0.0119591851","0.0042846775" , "0.0355244722" , "0.0740462817" , "0.0453380925" , "0.0113319981" , "0.0240854384" , "0.0395698086" , "0.4160391972" , "0.0116140229", "0.0067039882" , "0.0124718950" , "0.0012684350" , "0.0475395738" , "0.0146208298" , "0.0417926527" , "0.0052964620", "0.0019407557" , "0.0037666638" )

p12_exc <- c("BRL", "BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL")

p12_wlist <- cbind(p12_list, p12_w, p12_exc)

colnames(p12_wlist) <- c('ticker','weights','Currency')

#Download data Financial

p12 <- yf_get(tickers = p12_list, first_date = start, last_date = end,freq_data = "daily",thresh_bad_data = 0.5)

p12 <- p12[, c("ticker", "ref_date", "price_adjusted" ) ]

p12 <- merge(p12, p12_wlist , by = "ticker")

# Download data Exchange rate

getFX("BRL/USD",from=start , to = end)

exchanges <- as.data.frame(BRLUSD)

exchanges$ref_date <- as.Date(rownames(exchanges))

# Merge

p12 <- merge(p12, exchanges, by = "ref_date")

p12$BRL.USD[p12$Currency == "USD"] <- 1

# Adjusting currency

p12$price_adj <- p12$price_adjusted * p12$BRL.USD

# Calculating return

ret <- p12 %>%

group_by(ticker) %>%

tq_transmute(select = price_adj,

mutate_fun = periodReturn,

period = "daily",

col_rename = "ret")

p12 <- merge(p12, ret, by = c("ref_date", "ticker"))

# Data tabulation

p12$ret_product <- p12$ret * as.numeric(p12$weights)

# Creating a df of portfolios return

p12_ret <- p12 %>%

group_by(ref_date) %>%

summarise_at(vars(ret_product),

list(p12_return = sum)) %>% as.data.frame()

#Calculating cumulative return per day

for(i in (1:nrow(p12_ret) ) ) {

p12_ret$p12_cum[i] <- Return.cumulative(p12_ret$p12_return[1:i])

}

#Calculating cumulative return total

p12_sharpe <- data.frame(matrix(NA, nrow = 1,ncol = 4))

colnames(p12_sharpe) <- c('p12_return', 'p12_sd', 'p12_rf' , 'p12_sharpe')

p12_sharpe$p12_return <- Return.cumulative(p12_ret$p12_return)

p12_sharpe$p12_sd <- sd(p12_ret$p12_return[2:nrow(p12_ret)])

p12_sharpe$p12_rf <- (1+0.03)^(nrow(p12_ret)/252) -1

p12_sharpe$p12_sharpe <- (p12_sharpe$p12_return - p12_sharpe$p12_rf) / p12_sharpe$p12_sd13.2 The portfolio

This is the portfolio of this group:

ticker weights Currency

[1,] "VALE3.SA" "0.1432610332" "BRL"

[2,] "PETR3.SA" "0.0099774435" "BRL"

[3,] "CSAN3.SA" "0.0030409937" "BRL"

[4,] "ABEV3.SA" "0.0345260994" "BRL"

[5,] "RENT3.SA" "0.0119591851" "BRL"

[6,] "LREN3.SA" "0.0042846775" "BRL"

[7,] "RADL3.SA" "0.0355244722" "BRL"

[8,] "HYPE3.SA" "0.0740462817" "BRL"

[9,] "MDIA3.SA" "0.0453380925" "BRL"

[10,] "BRFS3.SA" "0.0113319981" "BRL"

[11,] "TOTS3.SA" "0.0240854384" "BRL"

[12,] "SQIA3.SA" "0.0395698086" "BRL"

[13,] "WEGE3.SA" "0.4160391972" "BRL"

[14,] "RAIL3.SA" "0.0116140229" "BRL"

[15,] "SBSP3.SA" "0.0067039882" "BRL"

[16,] "EGIE3.SA" "0.0124718950" "BRL"

[17,] "CCRO3.SA" "0.0012684350" "BRL"

[18,] "ENEV3.SA" "0.0475395738" "BRL"

[19,] "STBP3.SA" "0.0146208298" "BRL"

[20,] "ITUB4.SA" "0.0417926527" "BRL"

[21,] "BBAS3.SA" "0.0052964620" "BRL"

[22,] "SANB11.SA" "0.0019407557" "BRL"

[23,] "B3SA3.SA" "0.0037666638" "BRL" Checking the sum of weights. The sum of weights is:

13.2.1 The performance

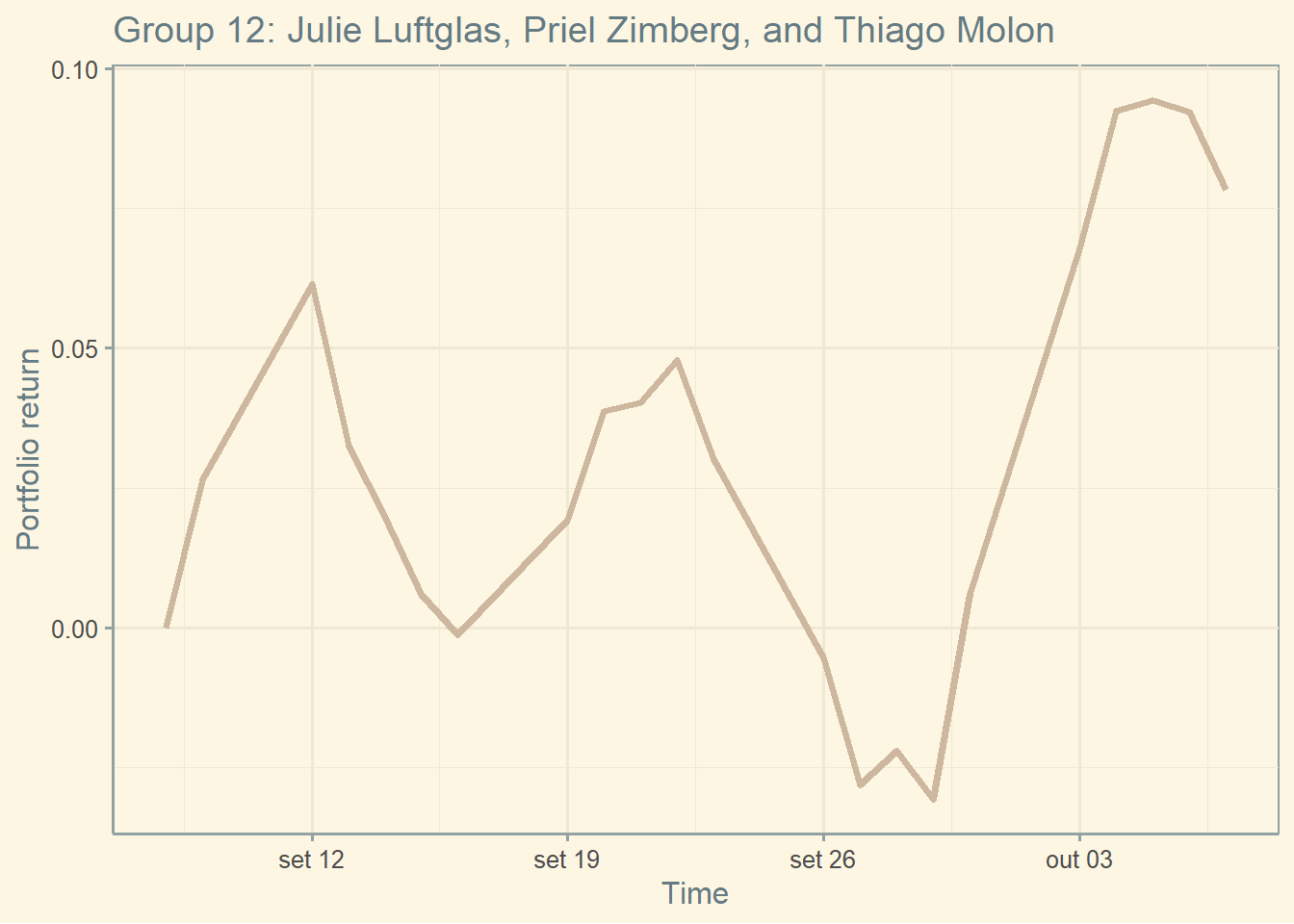

The current cumulative return of this Portfolio is 7.84 percent.

The current standard deviation of daily returns of this Portfolio is 2.4 percent.

The current Sharpe of this portfolio is 3.1576.

ggplot(p12_ret, aes(x= ref_date, y= p12_cum) ) + geom_line(color = "bisque3", size = 1.25) +

labs(y = "Portfolio return",

x = "Time",

title = "Group 12: Julie Luftglas, Priel Zimberg, and Thiago Molon") + theme_solarized()