library(dplyr)

library(yfR)

library(ggplot2)

library(PerformanceAnalytics)

library(PortfolioAnalytics)

library(tidyquant)

library(ggthemes)

library(tidyr)

library(writexl)

start <-'2022-09-08'

end <- Sys.Date() Portfolio Challenge

1 Portfolio Challenge

Important assumptions:

Risk-free rate is set 3% per year (reasonable for 2022 in the US).

All returns are calculated in USD. Stock prices in other currencies are replaced by USD.

Exchange rates are downloaded using getFX (more here).

Important Dates:

| Event | Dates |

|---|---|

| Checking the portfolios | September 05 |

| Challenge starts | September 08 |

| Report deadline | September 20 |

| Challenge ends | October 07 |

Prizes

- Best Sharpe ratio:

- Best Portfolio report

- Best coding analysis

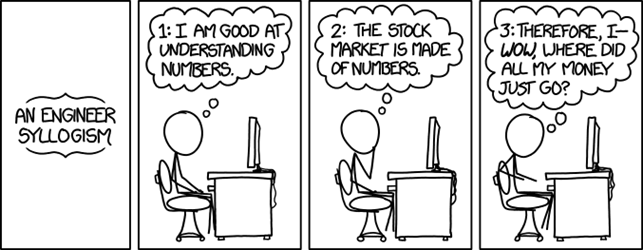

Be aware of the overconfidence trap!

.

.