12 Group 11

Managers: Benedita Coura, Isabella Adler, and Maria Luiza

12.1 The setup

p11_list <- c("AMER3.SA", "RADLY" , "BEEF3.SA", "JBSS3.SA" , "VBBR3.SA" ,"MELI34.SA" , "AAPL" ,"CRFB3.SA", "DIS", "ITSA4.SA" , "QETH11.SA")

p11_w <- c( "0.050", "0.080" , "0.070" , "0.100" , "0.220" , "0.100" , "0.170" , "0.050" , "0.090" , "0.050" , "0.020" )

p11_exc <- c("BRL", "USD","BRL","BRL","BRL","BRL","USD","BRL","USD")

p11_wlist <- cbind(p11_list, p11_w, p11_exc)

colnames(p11_wlist) <- c('ticker','weights','Currency')

#Download data Financial

p11 <- yf_get(tickers = p11_list, first_date = start, last_date = end,freq_data = "daily", thresh_bad_data = 0.5)

p11 <- p11[, c("ticker", "ref_date", "price_adjusted" ) ]

p11 <- merge(p11, p11_wlist , by = "ticker")

# Download data Exchange rate

getFX("BRL/USD",from=start , to = end)

exchanges <- as.data.frame(BRLUSD)

exchanges$ref_date <- as.Date(rownames(exchanges))

# Merge

p11 <- merge(p11, exchanges, by = "ref_date")

p11$BRL.USD[p11$Currency == "USD"] <- 1

# Adjusting currency

p11$price_adj <- p11$price_adjusted * p11$BRL.USD

# Calculating return

ret <- p11 %>%

group_by(ticker) %>%

tq_transmute(select = price_adj,

mutate_fun = periodReturn,

period = "daily",

col_rename = "ret")

p11 <- merge(p11, ret, by = c("ref_date", "ticker"))

# Data tabulation

p11$ret_product <- p11$ret * as.numeric(p11$weights)

# Creating a df of portfolios return

p11_ret <- p11 %>%

group_by(ref_date) %>%

summarise_at(vars(ret_product),

list(p11_return = sum)) %>% as.data.frame()

#Calculating cumulative return per day

for(i in (1:nrow(p11_ret) ) ) {

p11_ret$p11_cum[i] <- Return.cumulative(p11_ret$p11_return[1:i])

}

#Calculating cumulative return total

p11_sharpe <- data.frame(matrix(NA, nrow = 1,ncol = 4))

colnames(p11_sharpe) <- c('p11_return', 'p11_sd', 'p11_rf' , 'p11_sharpe')

p11_sharpe$p11_return <- Return.cumulative(p11_ret$p11_return)

p11_sharpe$p11_sd <- sd(p11_ret$p11_return[2:nrow(p11_ret)])

p11_sharpe$p11_rf <- (1+0.03)^(nrow(p11_ret)/252) -1

p11_sharpe$p11_sharpe <- (p11_sharpe$p11_return - p11_sharpe$p11_rf) / p11_sharpe$p11_sd12.2 The portfolio

This is the portfolio of this group:

ticker weights Currency

[1,] "AMER3.SA" "0.050" "BRL"

[2,] "RADLY" "0.080" "USD"

[3,] "BEEF3.SA" "0.070" "BRL"

[4,] "JBSS3.SA" "0.100" "BRL"

[5,] "VBBR3.SA" "0.220" "BRL"

[6,] "MELI34.SA" "0.100" "BRL"

[7,] "AAPL" "0.170" "USD"

[8,] "CRFB3.SA" "0.050" "BRL"

[9,] "DIS" "0.090" "USD"

[10,] "ITSA4.SA" "0.050" "BRL"

[11,] "QETH11.SA" "0.020" "USD" Checking the sum of weights. The sum of weights is:

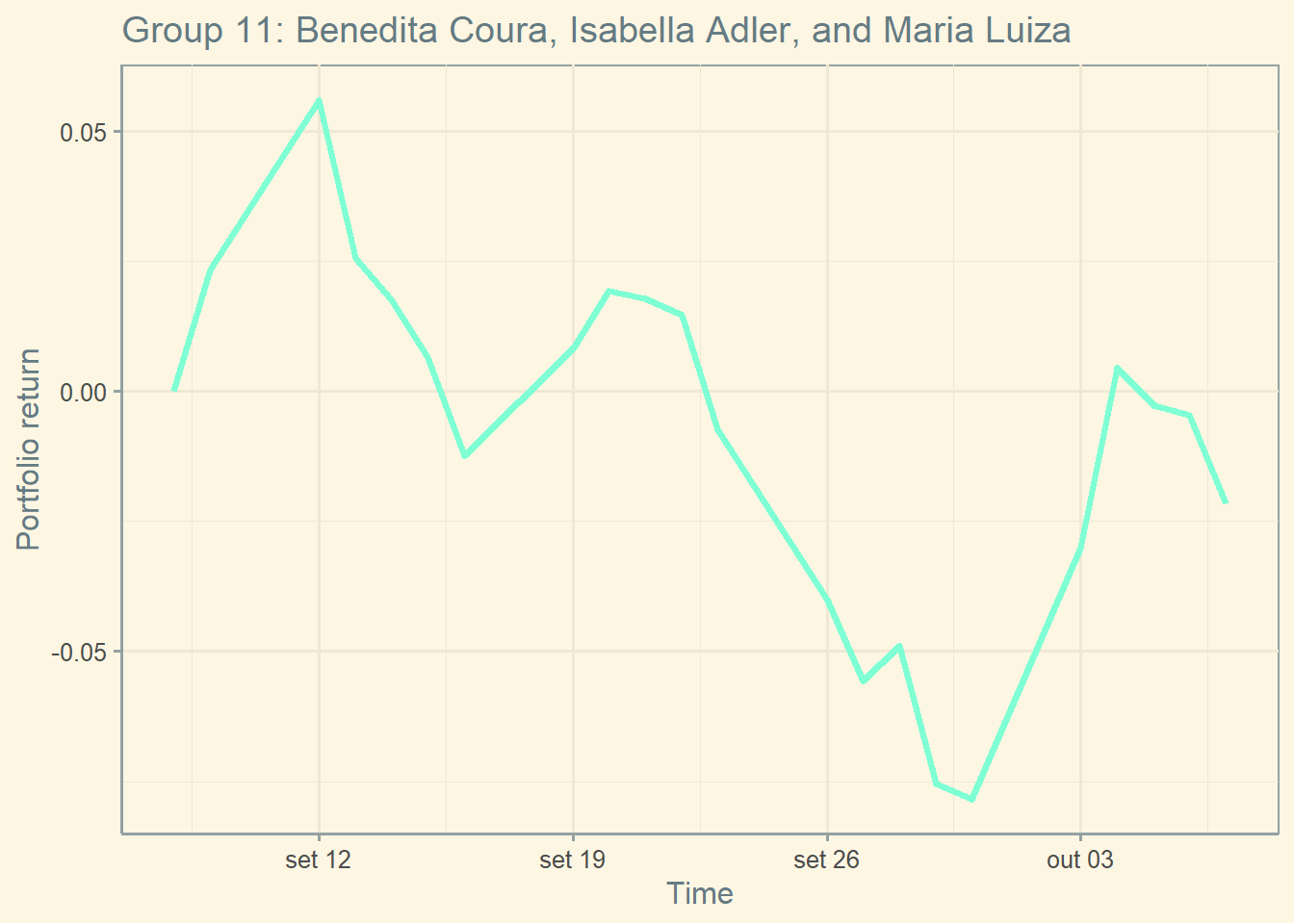

12.2.1 The performance

The current cumulative return of this Portfolio is -2.17 percent.

The current standard deviation of daily returns of this Portfolio is 2.29 percent.

The current Sharpe of this portfolio is -1.0584.

ggplot(p11_ret, aes(x= ref_date, y= p11_cum) ) + geom_line(color = "aquamarine", size = 1.25) +

labs(y = "Portfolio return",

x = "Time",

title = "Group 11: Benedita Coura, Isabella Adler, and Maria Luiza") + theme_solarized()