10 Group 9

Managers: Arthur Camis and Arthur Pillete

10.1 The setup

p9_list <-c("CVCB3.SA","USIM5.SA","VALE3.SA","GGBR4.SA", "NTCO3.SA")

p9_w <- c("0.3" , "0.3", "0.15", "0.10","0.15")

p9_exc <- c("BRL","BRL","BRL","BRL", "BRL" )

p9_wlist <- cbind(p9_list, p9_w, p9_exc)

colnames(p9_wlist) <- c('ticker','weights','Currency')

#Download data Financial

p9 <- yf_get(tickers = p9_list, first_date = start, last_date = end,freq_data = "daily", thresh_bad_data = 0.5)

p9 <- p9[, c("ticker", "ref_date", "price_adjusted" ) ]

p9 <- merge(p9, p9_wlist , by = "ticker")

# Download data Exchange rate

getFX("BRL/USD",from=start , to = end)

exchanges <- as.data.frame(BRLUSD)

exchanges$ref_date <- as.Date(rownames(exchanges))

# Merge

p9 <- merge(p9, exchanges, by = "ref_date")

p9$BRL.USD[p9$Currency == "USD"] <- 1

# Adjusting currency

p9$price_adj <- p9$price_adjusted * p9$BRL.USD

# Calculating return

ret <- p9 %>%

group_by(ticker) %>%

tq_transmute(select = price_adj,

mutate_fun = periodReturn,

period = "daily",

col_rename = "ret")

p9 <- merge(p9, ret, by = c("ref_date", "ticker"))

# Data tabulation

p9$ret_product <- p9$ret * as.numeric(p9$weights)

# Creating a df of portfolios return

p9_ret <- p9 %>%

group_by(ref_date) %>%

summarise_at(vars(ret_product),

list(p9_return = sum)) %>% as.data.frame()

#Calculating cumulative return per day

for(i in (1:nrow(p9_ret) ) ) {

p9_ret$p9_cum[i] <- Return.cumulative(p9_ret$p9_return[1:i])

}

#Calculating cumulative return total

p9_sharpe <- data.frame(matrix(NA, nrow = 1,ncol = 4))

colnames(p9_sharpe) <- c('p9_return', 'p9_sd', 'p9_rf' , 'p9_sharpe')

p9_sharpe$p9_return <- Return.cumulative(p9_ret$p9_return)

p9_sharpe$p9_sd <- sd(p9_ret$p9_return[2:nrow(p9_ret)])

p9_sharpe$p9_rf <- (1+0.03)^(nrow(p9_ret)/252) -1

p9_sharpe$p9_sharpe <- (p9_sharpe$p9_return - p9_sharpe$p9_rf) / p9_sharpe$p9_sd10.2 The portfolio

This is the portfolio of this group:

p9_wlist ticker weights Currency

[1,] "CVCB3.SA" "0.3" "BRL"

[2,] "USIM5.SA" "0.3" "BRL"

[3,] "VALE3.SA" "0.15" "BRL"

[4,] "GGBR4.SA" "0.10" "BRL"

[5,] "NTCO3.SA" "0.15" "BRL" Checking the sum of weights. The sum of weights is:

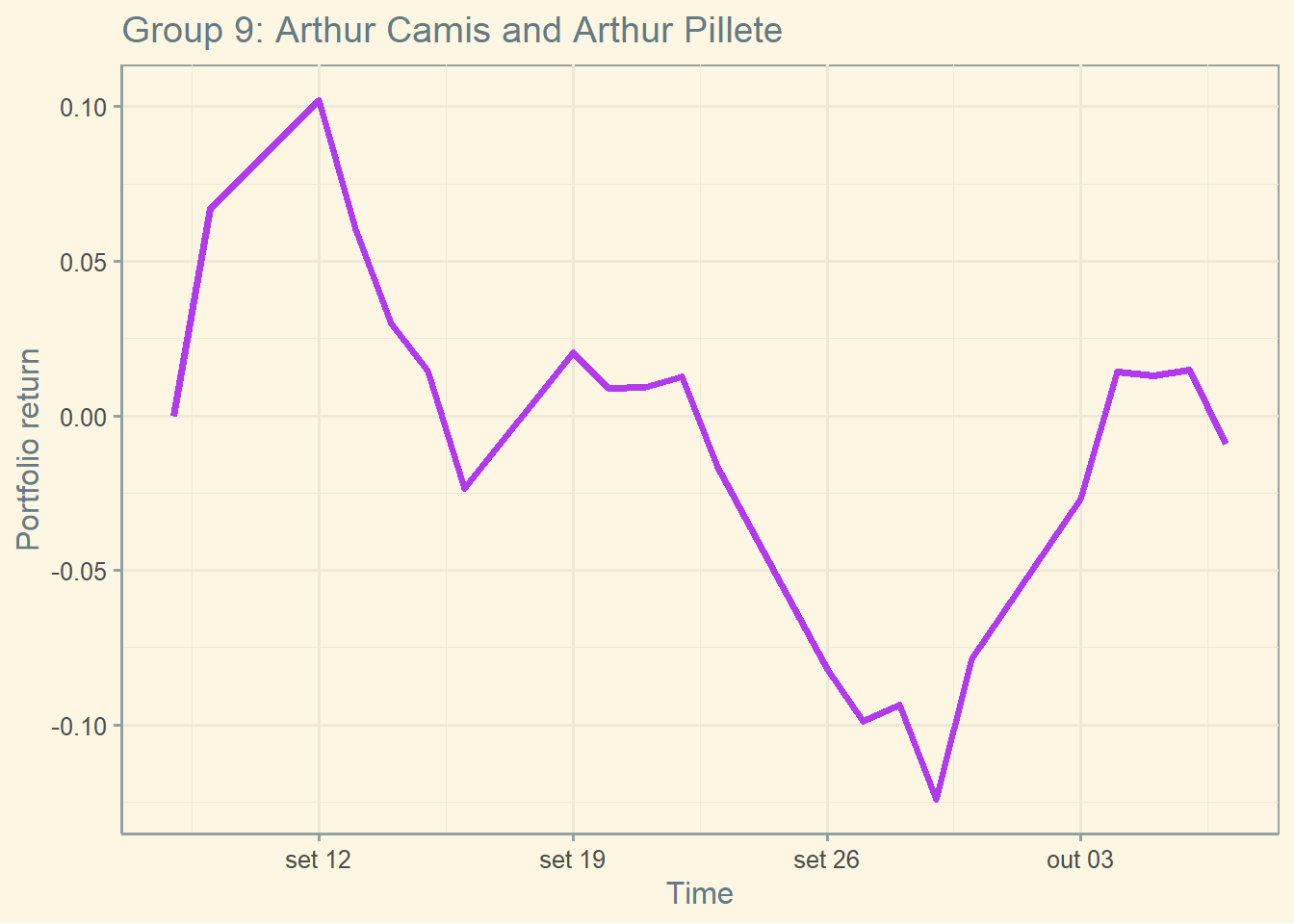

10.3 The performance

The current cumulative return of this Portfolio is -0.92 percent.

The current standard deviation of daily returns of this Portfolio is 3.64 percent.

The current Sharpe of this portfolio is -0.324.

ggplot(p9_ret, aes(x= ref_date, y= p9_cum) ) + geom_line(color = "darkorchid2", size = 1.25) +

labs(y = "Portfolio return",

x = "Time",

title = "Group 9: Arthur Camis and Arthur Pillete") + theme_solarized()