11 Group 10

Managers: Barbara Giarrante, Julia Dzura and Luiza Meneghin

11.1 The setup

p10_list <- c("ABEV3.SA", "ARZZ3.SA" , "BPAC11.SA" , "IGTI11.SA" , "RDOR3.SA" , "VALE3.SA" , "VBBR3.SA" , "WEGE3.SA" )

p10_w <- c("0.0625000000","0.1250000000","0.1666666667","0.1666666667","0.1666666667","0.0625000000","0.1250000000","0.1250000000")

p10_exc <- c("BRL","BRL","BRL","BRL","BRL","BRL","BRL","BRL" )

p10_wlist <- cbind(p10_list, p10_w, p10_exc)

colnames(p10_wlist) <- c('ticker','weights','Currency')

#Download data Financial

p10 <- yf_get(tickers = p10_list, first_date = start, last_date = end,freq_data = "daily",thresh_bad_data=0.5)

p10 <- p10[, c("ticker", "ref_date", "price_adjusted" ) ]

p10 <- merge(p10, p10_wlist , by = "ticker")

# Download data Exchange rate

getFX("BRL/USD",from=start , to = end)

exchanges <- as.data.frame(BRLUSD)

exchanges$ref_date <- as.Date(rownames(exchanges))

# Merge

p10 <- merge(p10, exchanges, by = "ref_date")

p10$BRL.USD[p10$Currency == "USD"] <- 1

# Adjusting currency

p10$price_adj <- p10$price_adjusted * p10$BRL.USD

# Calculating return

ret <- p10 %>%

group_by(ticker) %>%

tq_transmute(select = price_adj,

mutate_fun = periodReturn,

period = "daily",

col_rename = "ret")

p10 <- merge(p10, ret, by = c("ref_date", "ticker"))

# Data tabulation

p10$ret_product <- p10$ret * as.numeric(p10$weights)

# Creating a df of portfolios return

p10_ret <- p10 %>%

group_by(ref_date) %>%

summarise_at(vars(ret_product),

list(p10_return = sum)) %>% as.data.frame()

#Calculating cumulative return per day

for(i in (1:nrow(p10_ret) ) ) {

p10_ret$p10_cum[i] <- Return.cumulative(p10_ret$p10_return[1:i])

}

#Calculating cumulative return total

p10_sharpe <- data.frame(matrix(NA, nrow = 1,ncol = 4))

colnames(p10_sharpe) <- c('p10_return', 'p10_sd', 'p10_rf' , 'p10_sharpe')

p10_sharpe$p10_return <- Return.cumulative(p10_ret$p10_return)

p10_sharpe$p10_sd <- sd(p10_ret$p10_return[2:nrow(p10_ret)])

p10_sharpe$p10_rf <- (1+0.03)^(nrow(p10_ret)/252) -1

p10_sharpe$p10_sharpe <- (p10_sharpe$p10_return - p10_sharpe$p10_rf) / p10_sharpe$p10_sd11.2 The portfolio

This is the portfolio of this group:

p10_wlist ticker weights Currency

[1,] "ABEV3.SA" "0.0625000000" "BRL"

[2,] "ARZZ3.SA" "0.1250000000" "BRL"

[3,] "BPAC11.SA" "0.1666666667" "BRL"

[4,] "IGTI11.SA" "0.1666666667" "BRL"

[5,] "RDOR3.SA" "0.1666666667" "BRL"

[6,] "VALE3.SA" "0.0625000000" "BRL"

[7,] "VBBR3.SA" "0.1250000000" "BRL"

[8,] "WEGE3.SA" "0.1250000000" "BRL" Checking the sum of weights. The sum of weights is:

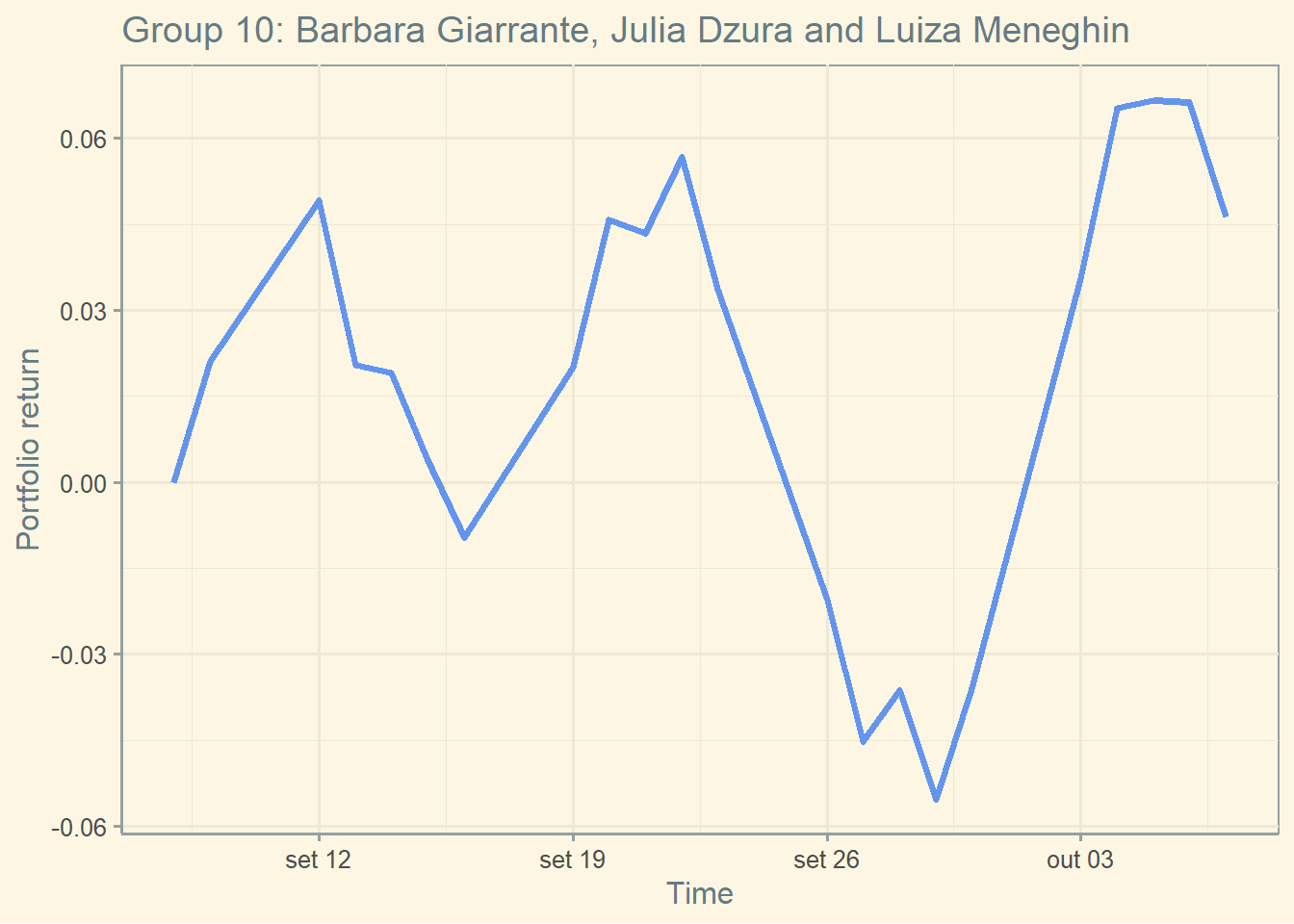

11.3 The performance

The current cumulative return of this Portfolio is 4.63 percent.

The current standard deviation of daily returns of this Portfolio is 2.77 percent.

The current Sharpe of this portfolio is 1.5795.

ggplot(p10_ret, aes(x= ref_date, y= p10_cum) ) + geom_line(color = "cornflowerblue", size = 1.25) +

labs(y = "Portfolio return",

x = "Time",

title = "Group 10: Barbara Giarrante, Julia Dzura and Luiza Meneghin") + theme_solarized()