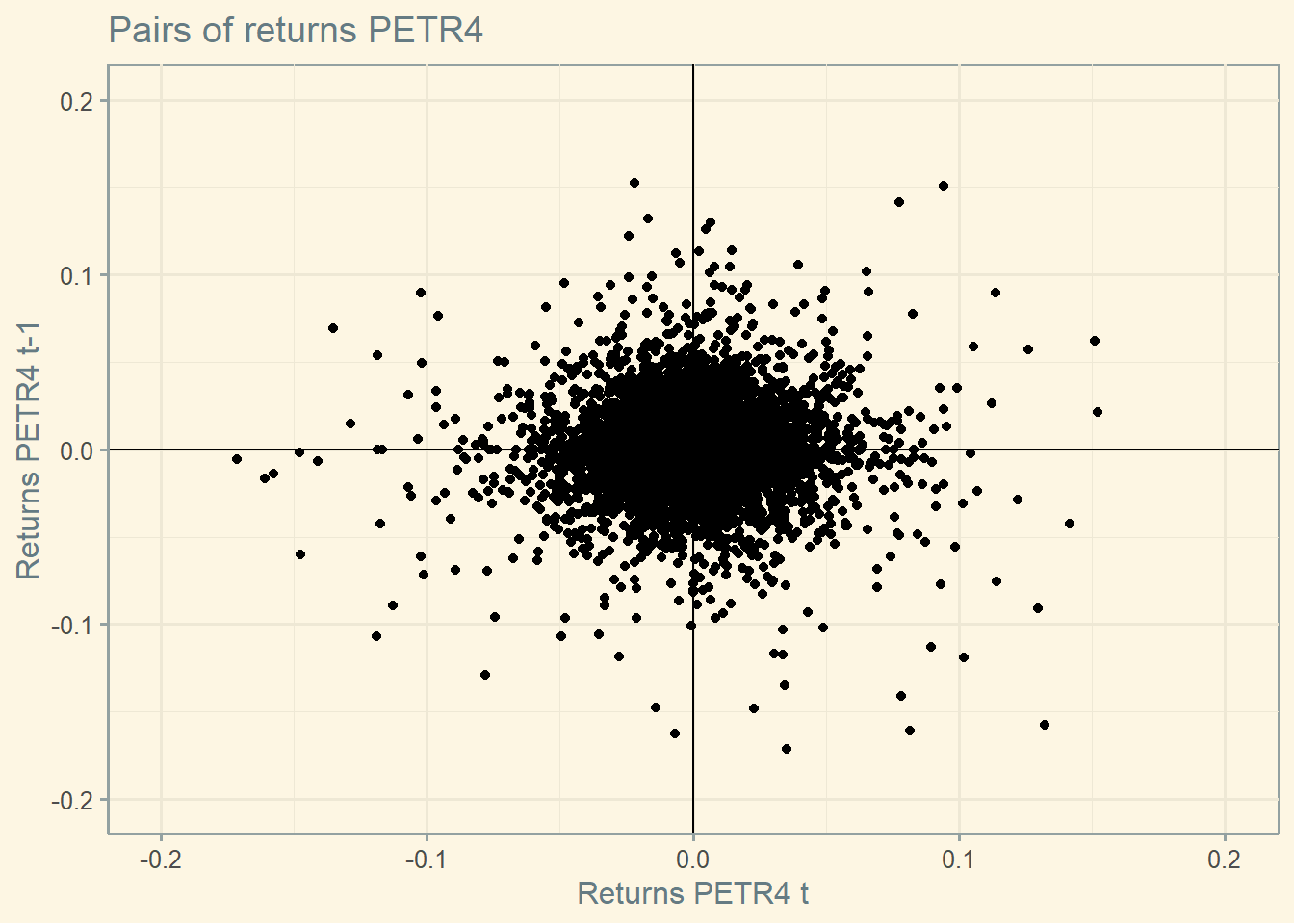

The graph below reproduces Figure 13.1 of BMA using data from Petrobras.

library(ggthemes)

library(yfR)

library(ggplot2)

library(dplyr)

library(tidyquant)

freq.data <- 'daily'

start <-'2000-01-01'

end <-Sys.Date()

asset <- yf_get(tickers = "PETR4.SA",

first_date = start,

last_date = end,

thresh_bad_data = 0.5,

freq_data = freq.data )

ret_asset <- asset %>%tq_transmute(select = price_adjusted,

mutate_fun = periodReturn,

period = 'daily',

col_rename = 'return',

type = 'log')

ret_asset$lag <- lag(ret_asset$return)

ggplot(ret_asset, aes(x= return, y=lag)) +

geom_point()+

labs( y = "Returns PETR4 t-1", x="Returns PETR4 t",title = "Pairs of returns PETR4")+

theme(plot.title = element_text(color="darkblue", size=15, face="bold"),

panel.background = element_rect(fill = "grey95", colour = "grey95"),

axis.title=element_text(size=12,face="bold"),

title=element_text(size=10,face="bold", color="darkblue"),

axis.text.y = element_text(face = "bold", color = "darkblue", size = 10),

axis.text.x = element_text(face = "bold", color = "darkblue", size = 10))+

xlim(-0.2, 0.2) + ylim(-0.2, 0.2)+

geom_hline(yintercept = 0) +

geom_vline(xintercept = 0) + theme_solarized()