#### QUANDL API

# Passos necessC!rios antes de continuar com o cC3digoa baixo

# 1. Acesse https://www.quandl.com/

# 2. Crie uma conta no site

# 3. Obtenha uma API Key

# 4. Adicione sua API Key nos parC"metros abaixo

library(GetQuandlData)

library(ggplot2)

library(ggthemes)

library(GetTDData)

api_KEY <- "Your KEY here"

# Selic BCB/11 or BCB/4390 or BCB/4189

first_date <- '2000-01-01'

last_date <- '2023-01-01'

selic <- get_Quandl_series(id_in = c('Selic' = 'BCB/4189'),

api_key = api_key,

first_date = first_date,

last_date = last_date)

cdi <- get_Quandl_series(id_in = c('CDI' = 'BCB/12'),

api_key = api_key,

first_date = first_date,

last_date = last_date)

inf <- get_Quandl_series(id_in = c('Inflation' = 'BCB/433'),

api_key = api_key,

first_date = first_date,

last_date = last_date)2 Macro Brazil

This is a book containing all class notes.

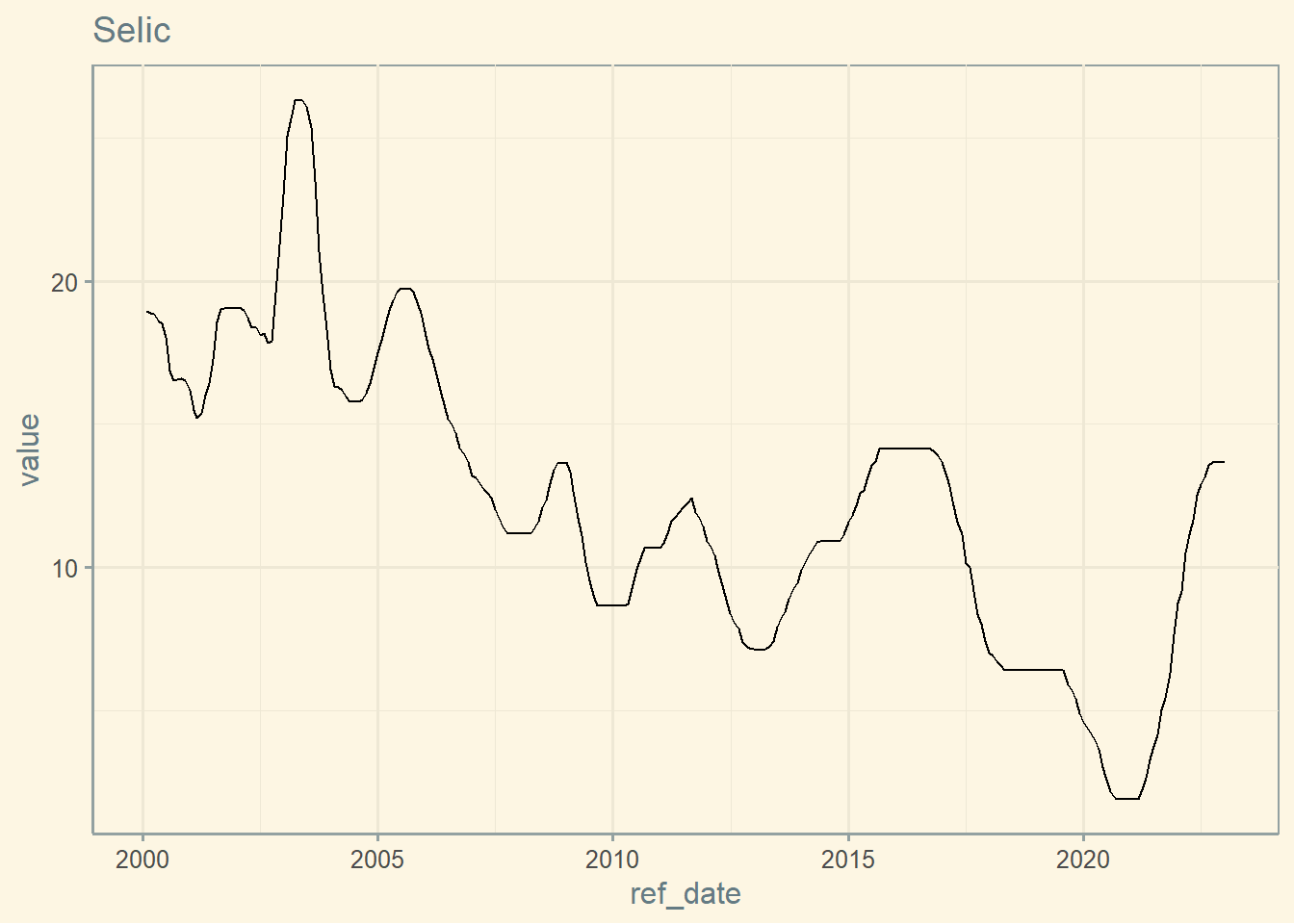

2.1 Selic

ggplot(selic, aes( x = ref_date, y= value)) + geom_line() + labs(title = "Selic")+

theme(axis.text.x = element_text(color = "grey20", size = 15, angle = 0, hjust = .5, vjust = .5, face = "plain"),

axis.text.y = element_text(color = "grey20", size = 15, angle = 0, hjust = 1, vjust = 0, face = "plain"),

axis.title.x = element_text(color = "grey20", size = 15, angle = 0, hjust = .5, vjust = 0, face = "plain"),

axis.title.y = element_text(color = "grey20", size = 15, angle = 90, hjust = .5, vjust = .5, face = "plain")) + theme_solarized()

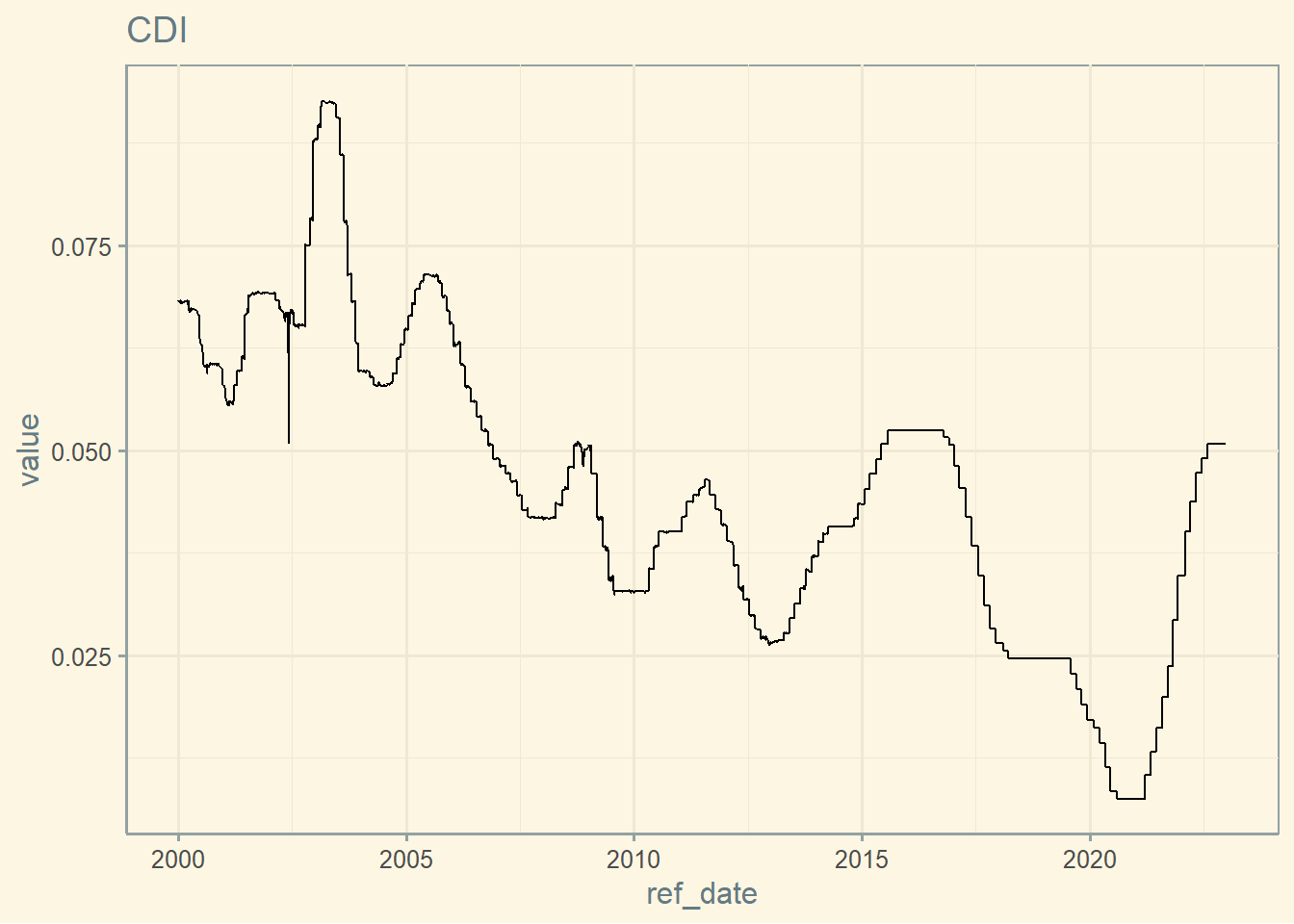

2.2 CDI

ggplot(cdi, aes( x = ref_date, y= value)) + geom_line() + labs(title = "CDI")+

theme(axis.text.x = element_text(color = "grey20", size = 15, angle = 0, hjust = .5, vjust = .5, face = "plain"),

axis.text.y = element_text(color = "grey20", size = 15, angle = 0, hjust = 1, vjust = 0, face = "plain"),

axis.title.x = element_text(color = "grey20", size = 15, angle = 0, hjust = .5, vjust = 0, face = "plain"),

axis.title.y = element_text(color = "grey20", size = 15, angle = 90, hjust = .5, vjust = .5, face = "plain")) + theme_solarized()

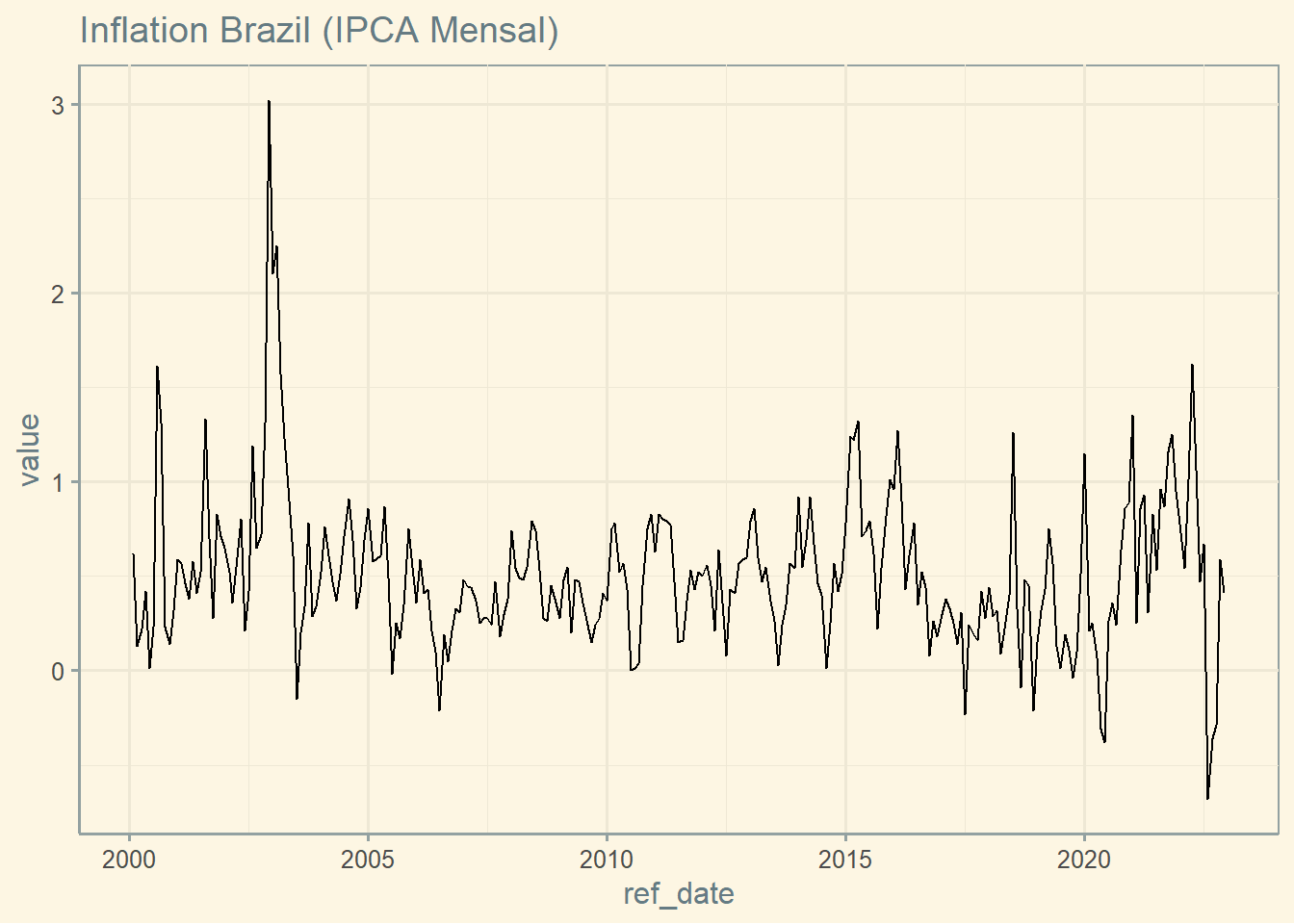

2.3 Inflation

ggplot(inf, aes( x = ref_date, y= value)) + geom_line() + labs(title = "Inflation Brazil (IPCA Mensal)")+

theme(axis.text.x = element_text(color = "grey20", size = 15, angle = 0, hjust = .5, vjust = .5, face = "plain"),

axis.text.y = element_text(color = "grey20", size = 15, angle = 0, hjust = 1, vjust = 0, face = "plain"),

axis.title.x = element_text(color = "grey20", size = 15, angle = 0, hjust = .5, vjust = 0, face = "plain"),

axis.title.y = element_text(color = "grey20", size = 15, angle = 90, hjust = .5, vjust = .5, face = "plain")) + theme_solarized()

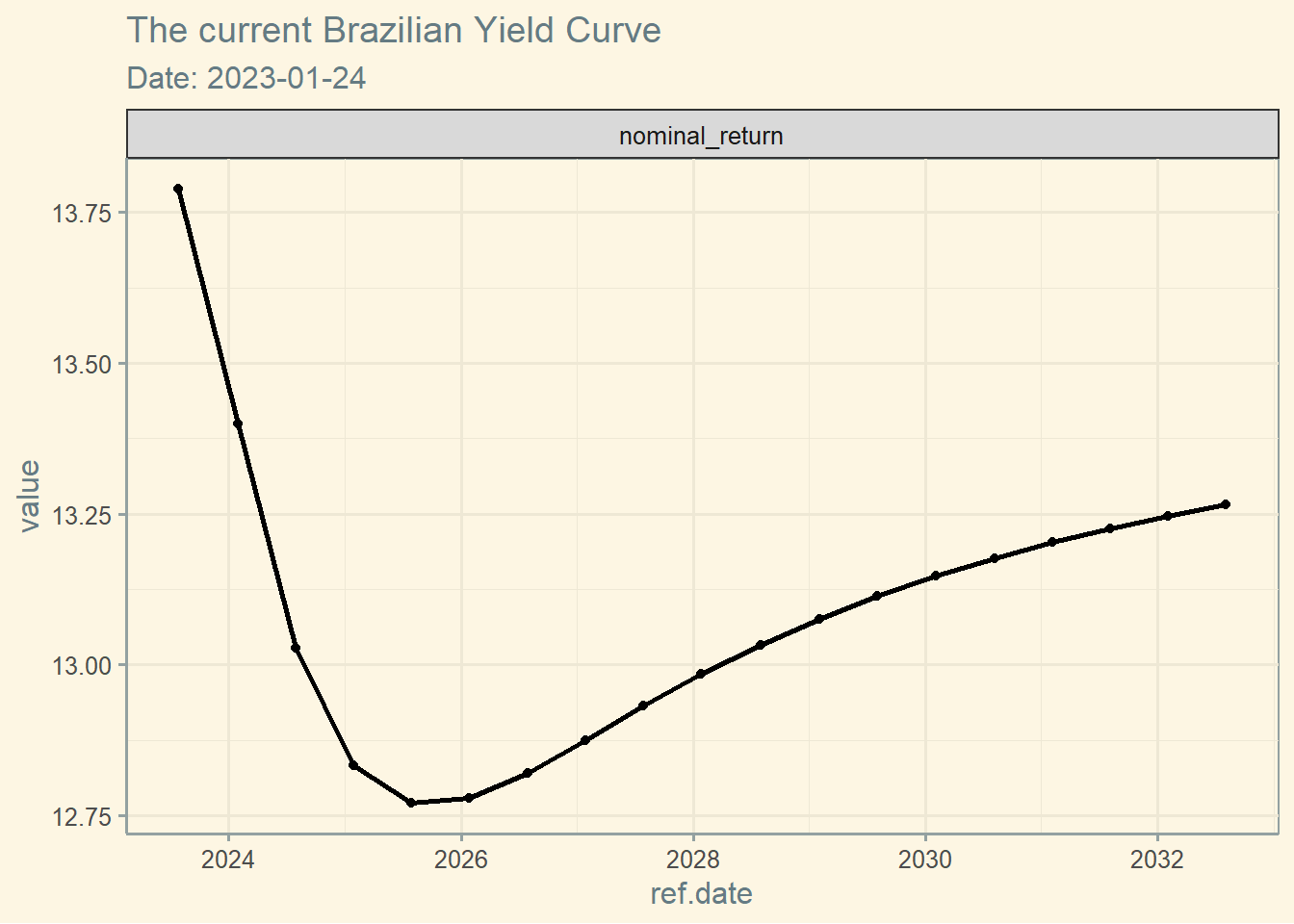

2.4 Term Structure

ettj = get.yield.curve()

ettj <- subset(ettj, type == "nominal_return" )

ggplot(ettj, aes(x=ref.date, y = value) ) +

geom_line(size=1) + geom_point() + facet_grid(~type, scales = 'free') +

labs(title = paste0('The current Brazilian Yield Curve '),

subtitle = paste0('Date: ', ettj$current.date[1])) +

theme(axis.text.x = element_text(color = "grey20", size = 15, angle = 0, hjust = .5, vjust = .5, face = "plain"),

axis.text.y = element_text(color = "grey20", size = 15, angle = 0, hjust = 1, vjust = 0, face = "plain"),

axis.title.x = element_text(color = "grey20", size = 15, angle = 0, hjust = .5, vjust = 0, face = "plain"),

axis.title.y = element_text(color = "grey20", size = 15, angle = 90, hjust = .5, vjust = .5, face = "plain")) + theme_solarized()