US

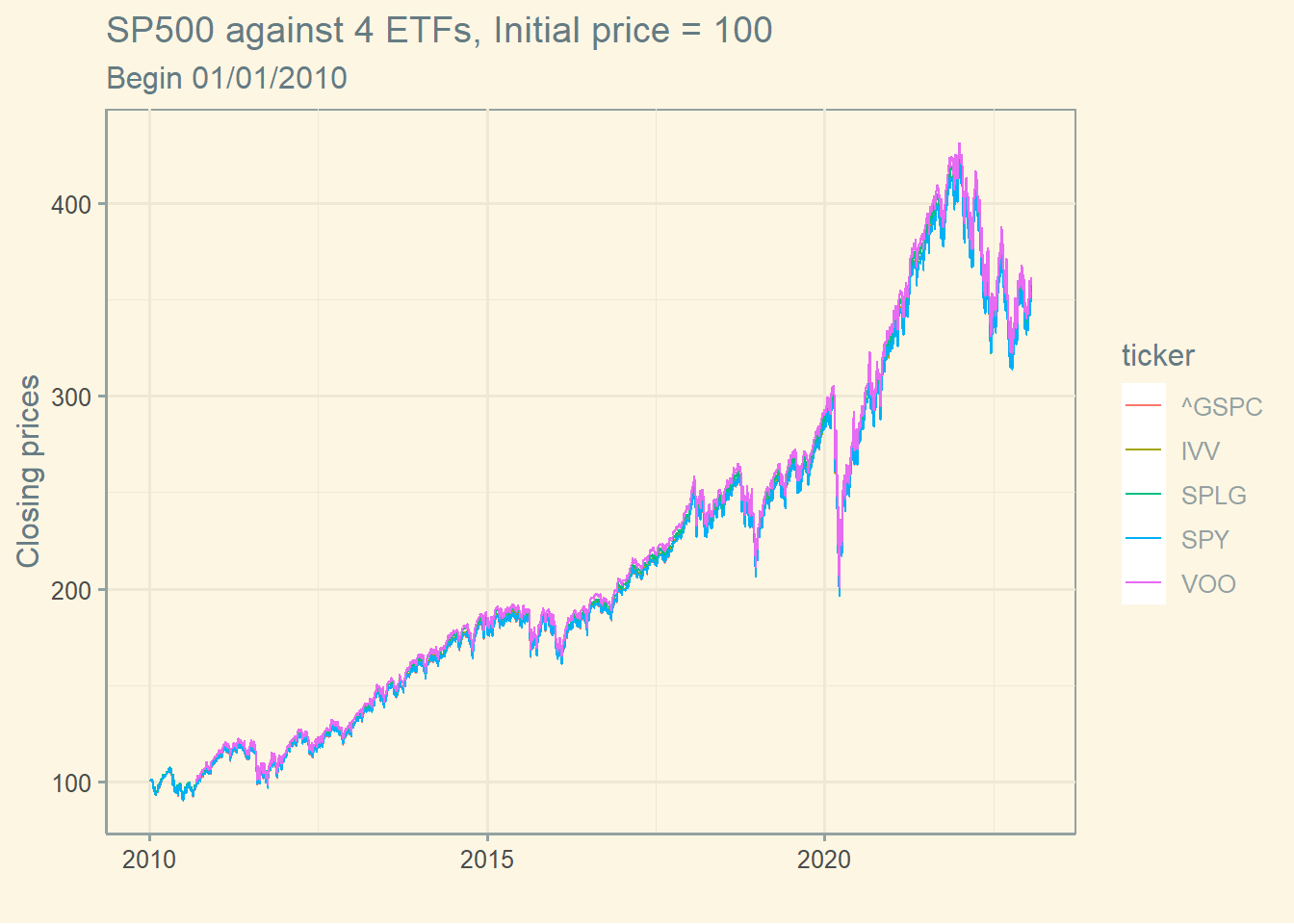

Let’s plot a graph of some Exchange-traded funds (ETFs) available in the US market that follows the SP 500 index. As you can see, the adherence is amazing.

library (yfR)library (ggplot2)library (ggthemes)<- c ('SPY' , 'IVV' ,'VOO' , 'SPLG' , '^GSPC' ) <- '2010-01-01' <- Sys.Date () <- yf_get (tickers = stocks, first_date = start,last_date = end)<- data[complete.cases (data),] <- subset (data, ticker == stocks[1 ])<- subset (data, ticker == stocks[2 ])<- subset (data, ticker == stocks[3 ])<- subset (data, ticker == stocks[4 ])<- subset (data, ticker == stocks[5 ])$ price_close2 <- stock1$ price_close / stock1$ price_close[1 ] * 100 $ price_close2 <- stock2$ price_close / stock2$ price_close[1 ] * 100 $ price_close2 <- stock3$ price_close / stock3$ price_close[1 ] * 100 $ price_close2 <- stock4$ price_close / stock4$ price_close[1 ] * 100 $ price_close2 <- stock5$ price_close / stock5$ price_close[1 ] * 100 <- rbind (stock1, stock2, stock3, stock4, stock5)ggplot (data2, aes (ref_date , price_close2, color= ticker))+ geom_line () + labs (x = "" ,y= 'Closing prices' , title= "SP500 against 4 ETFs, Initial price = 100" , subtitle = "Begin 01/01/2010" ) + theme_solarized ()

Brazil

Here is the same graph for brazilian ETF Bova11. The adherence seems ok.

library (yfR)library (ggplot2)library (ggthemes)<- c ('BOVA11.SA' , '^BVSP' ) <- '2010-01-01' <- Sys.Date () <- yf_get (tickers = stocks, first_date = start,last_date = end)<- data[complete.cases (data),] <- subset (data, ticker == stocks[1 ])<- subset (data, ticker == stocks[2 ])$ price_close2 <- stock1$ price_close / stock1$ price_close[1 ] * 100 $ price_close2 <- stock2$ price_close / stock2$ price_close[1 ] * 100 <- rbind (stock1, stock2)ggplot (data2, aes (ref_date , price_close2, color= ticker))+ geom_line () + labs (x = "" ,y= 'Closing prices' , title= "Ibov against 2 ETFs, Initial price = 100" , subtitle = "Begin 01/01/2010" ) + theme_solarized ()