ESG & Institutional Investment

Part 1

Henrique C. Martins

Introduction to G and Shareholder value

In this class, we will discuss the fundamental aspects of G and how they drive (or don’t drive) the implementation of E and S strategies.

We will discuss the firm, but keep in mind our focus here: - the investors.

To understand how investors will face ESG strategies and how they could incorporate ESG into their portfolios, we need to understand the impact of E&S on the firm.

How to Calculate Present Value

Traditionally, we calculate a firm’s value using the following concept:

\[NPV = \sum_{t=1}^{\infty} \frac{FCF_t}{(1+WACC)^t}\]

A firm generates cash flow in the future.

These cash flows are discounted to the present at a given discount rate.

The result is: the present value of the sum of these future cash flows.

This is the best proxy we have for the value of a firm.

There is no novelty here. This has been done for a long time now.

The internal mechanics of how a firm generates value leads to the study of G.

G

There are some alternative definitions of G:

Corporate governance deals with the ways in which suppliers of finance to corporations assure themselves of getting a return on their investment.

Andrei Shleifer and Robert Vishny 1997

We define CG as the collection of control mechanisms that an organization adopts to prevent or dissuade potentially self-interest managers from engaging in activities detrimental to the welfare of shareholders and stakeholders.

Larcker and Tayan

You may find more recent definitions of G addressing S issues.

I find that troublesome because they bring social issues to the G conversation.

The modern solution is to have both S and G separated (as topics of discussion), but obviously interconnected in a firm.

G

When we talk about G:

Board of directors (independence, diversity, etc.)

Ownership structure (concentration, rights, etc.)

CEO compensation

Capital structure decisions (monitoring by creditors)

Takeover market

The investors’ protection laws

Regulations, Auditors, etc.

G

G

One well understood goal of G is to mitigate (or “control”) Agency Conflicts.

Agency conflicts exist when managers pursue (private) goals not shared with investors (outsiders).

- Managers: agents

- Investors: principal

G mechanisms try to prevent agency conflicts. They are not perfect, but they usually work well.

- Of course, there is heterogeneity at the country level of how well they work.

G

At the end of the day, G leads to:

Better financial and strategic decisions today, increasing future FCF.

More transparency, decreasing WACC (investors more willing to finance the firm’s investments).

\[NPV = \sum_{t=1}^{\infty} \frac{FCF_t}{(1+WACC)^t}\]

Portfolio management

Let’s take a moment to see what is the maximization problem that an investor is trying to solve.

From an investor perspective, this is the maximization problem:

How to increase the return-risk ratio?

You can think in terms of the Sharpe ratio.

\[Sharpe\;ratio = \frac{E[R_p]-R_f}{Sd(R_p)}\]

Portfolio management

Portfolio management

So you combine

- different assets…

- with different risk profiles…

- with different correlations between them…

- from different classes…

- from different countries…

- and etc.

Portfolio management

You have to be smart in the “differences” you select. There is a “protocol”.

- Different investors’ profiles, risk tolerance, time horizon, etc.

Portfolio management

Portfolio management

Portfolio management

Portfolio management

Portfolio management

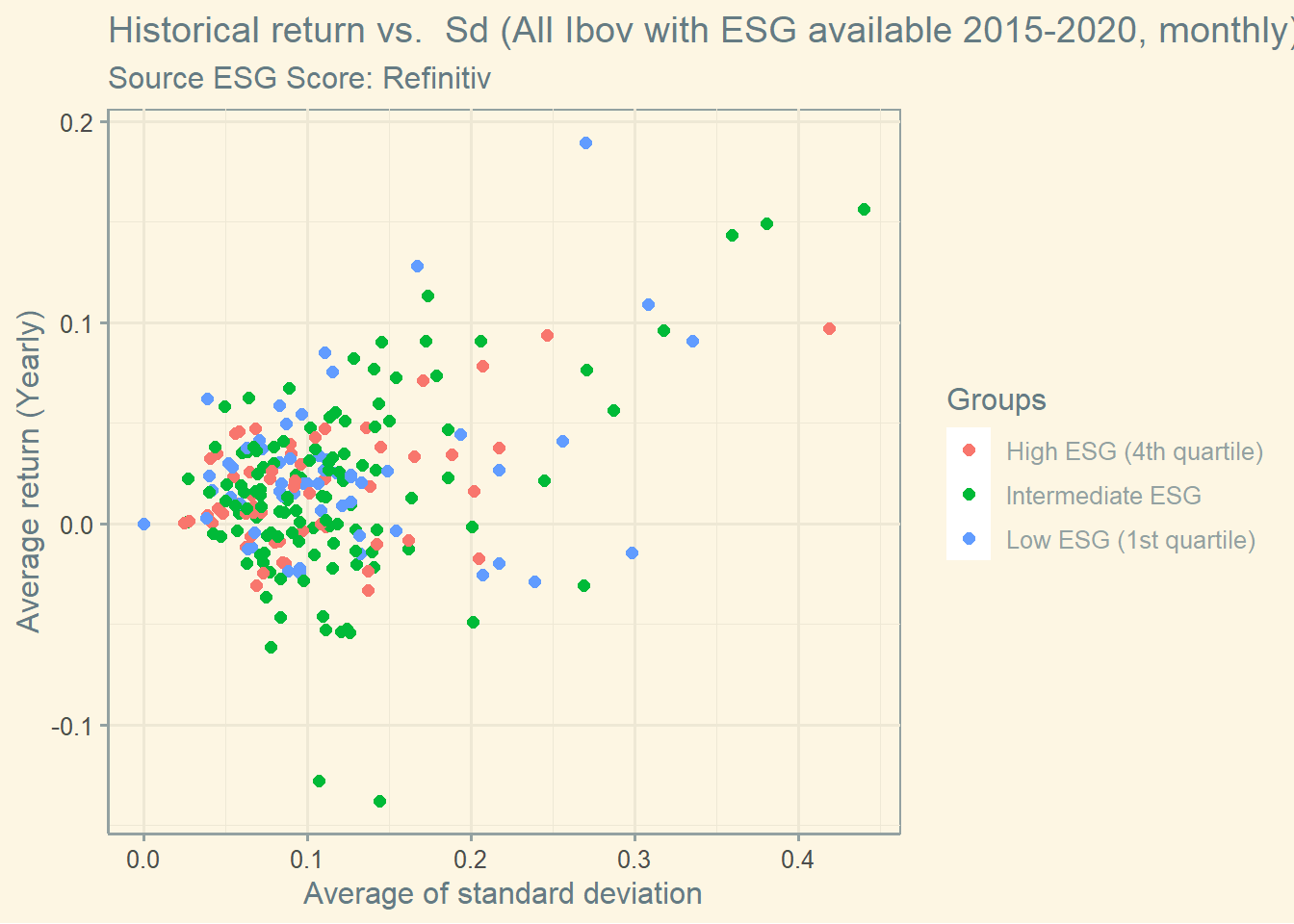

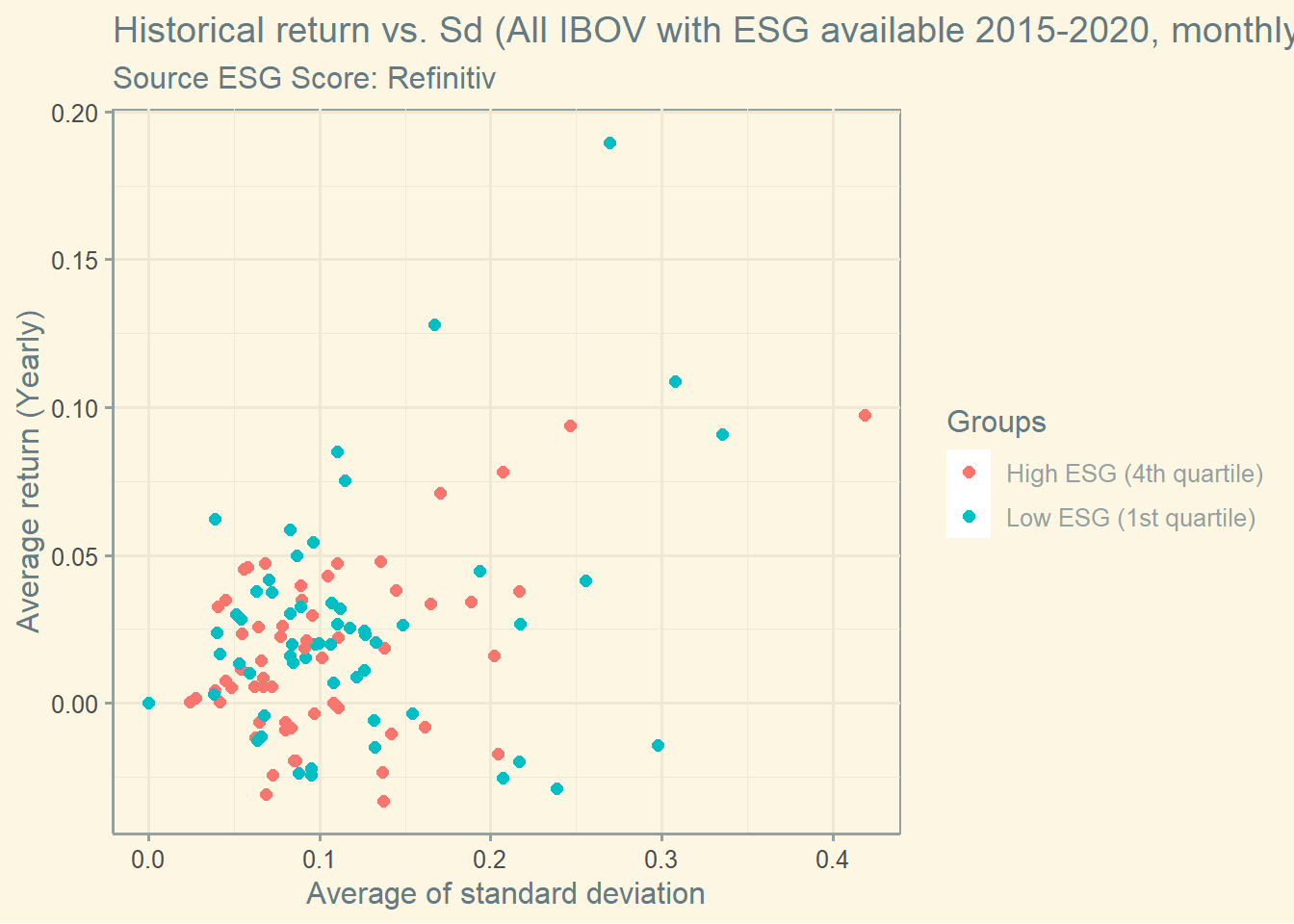

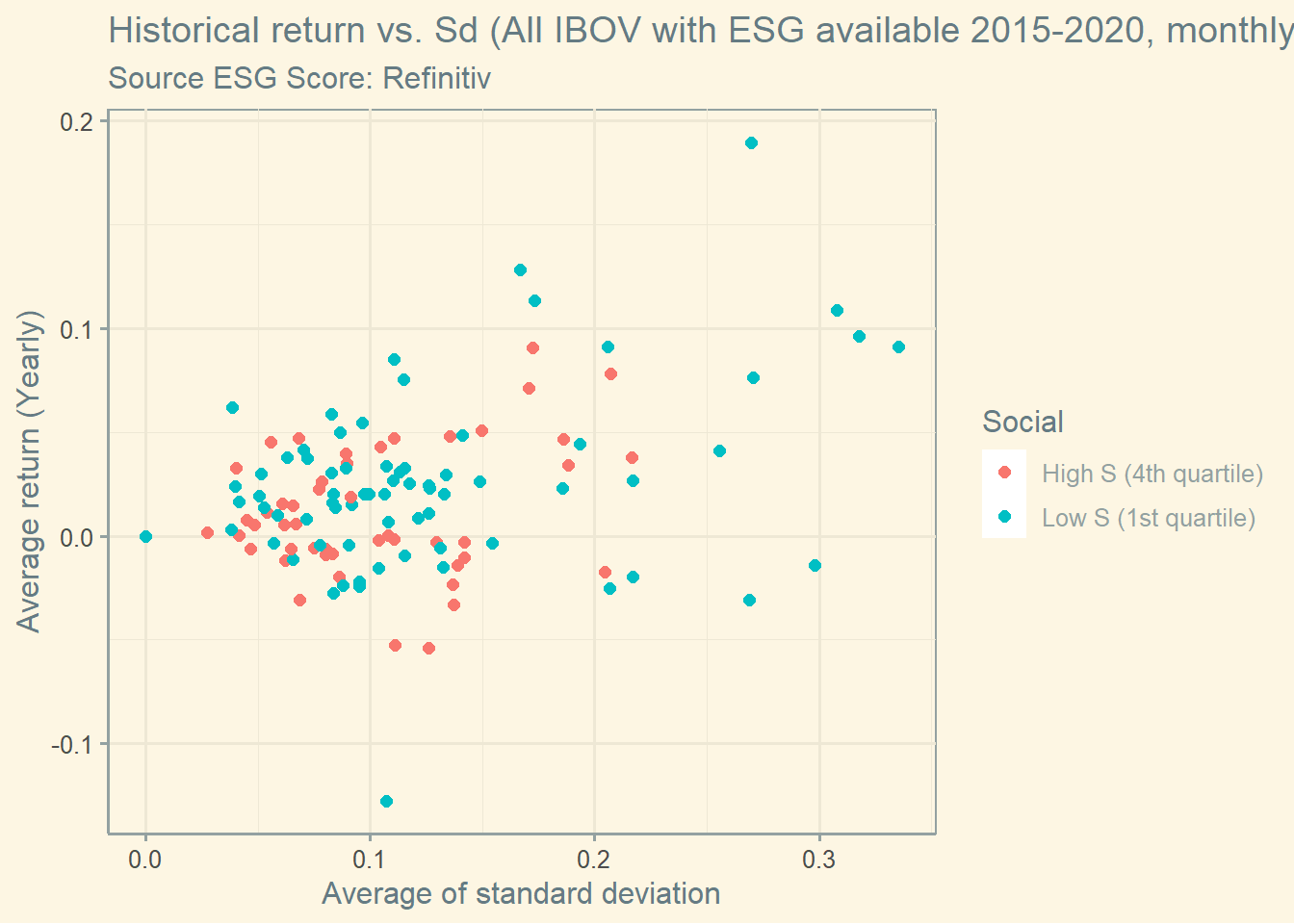

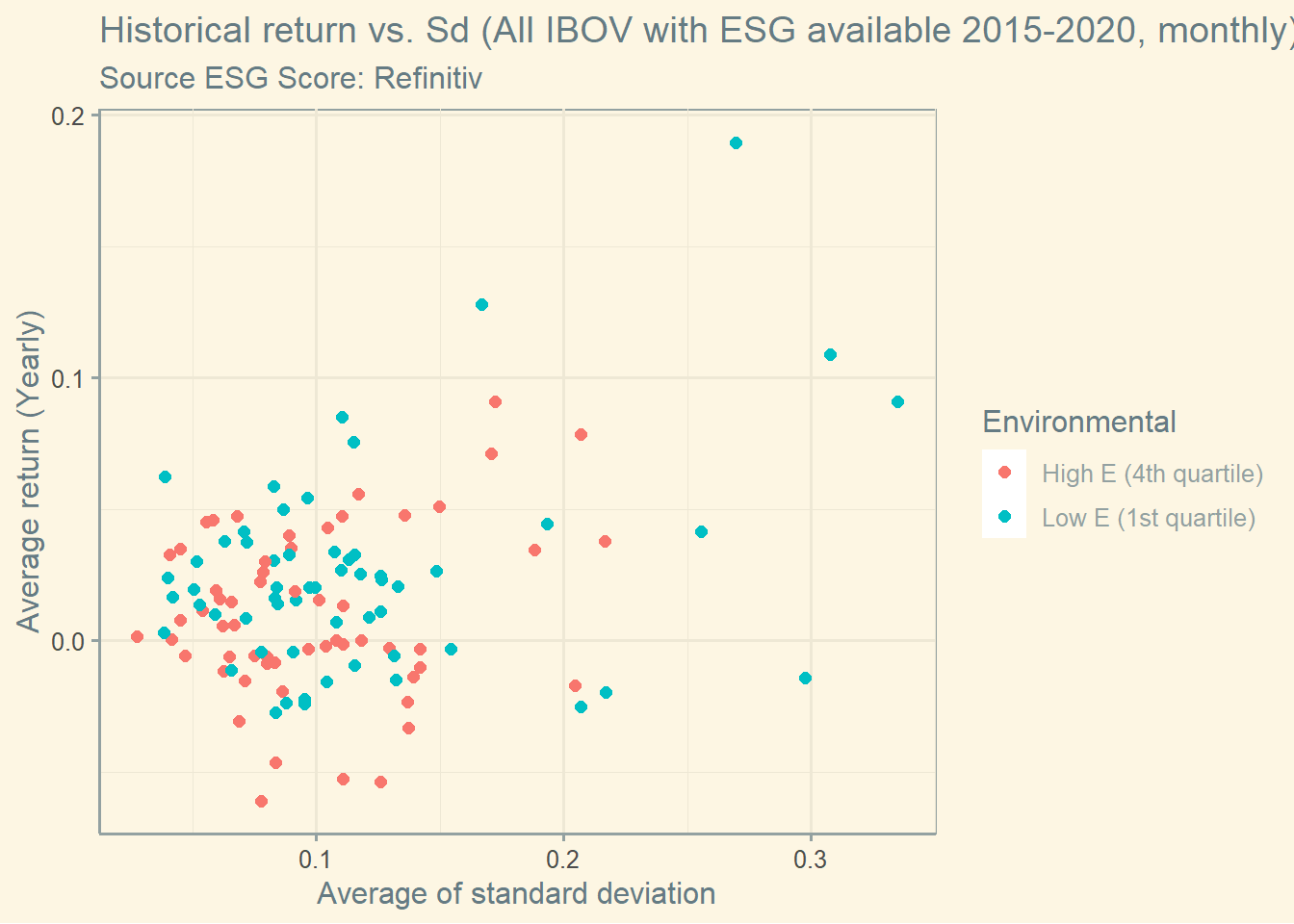

So, what is happening?

Are low-performance firms the ones investing in ESG (and maybe ESG brings performance back)?

Or ESG does not bring performance at all?

Important: This is an aggregate illustrative exercise.

I am not saying anything here, this is just data evidence, using Brazilian stocks and the Refinitiv Score.

It can be different in other places, periods of time, ESG scores, etc.

This is not a recommendation of investment.

Portfolio management

One main question we will try to answer (but honestly not sure we can) is:

Does bringing E&S to the G conversation provide better a return-risk ratio?

A central question is:

- There are some costs to invest in ESG practices, what are the cost-benefits of these practices?

- Maybe more profitable firms are those with the resources to invest in ESG practices (it is like a “perquisite”)…

- But maybe ESG is a form of differentiation, thus less profitable firms are those investing in ESG to compete in the modern markets (“run from competition”).

Portfolio management

In this course, we will look at what investors are doing to maximize the return-risk ratio…

… while attending not only to traditional but also more modern demands from:

- Climate change problems

- Social movements

- Diversity

- Etc.

Questions?

ESG Basics

So now let’s introduce the basics of ESG and how they are expected to drive the investors’ decisions & portfolio allocation.

ESG refers Environmental, Social, and Governance elements…

… and the way these elements converge to generate value and how they impact the firm and the stakeholders.

ESG Basics

Investors typically assess ESG factors using nonfinancial data on:

Environmental criteria address a firm’s operations environmental impact and environmental stewardship.

Social criteria refer to how a firm manages relationships with and creates value for stakeholders

Governance criteria refer to a firm’s leadership and management philosophy, practices, policies, internal controls, and shareholders’ rights.

- Environmental impact (e.g., carbon emissions),

- Social impact (e.g., employee satisfaction),

- Governance attributes (e.g., board structure).

ESG Basics

The idea is to bring these issues into the discussion so the firm and the investors incorporate them into decision-making processes.

ESG Basics

Firms receive ESG scores (they are like ratings):

This is the methodology of Refinitiv (one provider, there are others).

ESG Basics

Three things:

1) There is no consensus about which dimensions should be incorporated.

2) Firms usually pay to have a score.

3) Firms can have a strong E, and weak S, for instance.

ESG Basics

The ESG scores (all metrics, actually) are completely industry-specific. For example:

In some industries, carbon emissions are highly problematic (Automotive).

In others, they are not (for example, the financial system).

In some industries, customer relationship are highly problematic (tech companies).

In others, they are not (for example, the energy sector).

At the end of the day, you cannot compare ESG metrics and assessments between industries…

… unless there is some adaptation to make them comparable (we will discuss types of adaptations in the future).

ESG Basics

One important caveat of ESG nowadays:

The theory is not well developed yet.

While you can argue for (and mathematically show) the benefits of the shareholder-maximization paradigm and about the G …

… you don’t have the same math rigor about the E and the S.

ESG Basics

But that is changing:

ESG Basics

ESG Basics

ESG Basics

ESG Basics

Main takeaways

Scholars are trying to bring these concepts to the theoretic table.

Still, much of the discussion is based on passionate (and sometimes arbitrary) arguments.

This particular article seems to suggest that investors will accept lower Sharpe ratios from High ESG firms.

Also, this particular article creates the idea of a three-way optimization (return, risk, ESG), instead of only return and risk.

- The idea is to optimize Sharpe Ratio and ESG.

ESG Basics

ESG Basics

ESG is sometimes used interchangeably with CSR (Corporate Social responsibility) but ESG encompasses much more:

In the early 1990s, the idea of sustainability was created focusing on the environmental impacts that firms were having.

In the early 2000s, CSR brought corporate philanthropy and volunteerism in an attempt to fix social issues.

Nowadays, ESG uses a more holistic view in order to create value while attending E and S issues.

This new “trend” is different because (at some level) now investors are willing to change and adjust portfolios.

Not only they are willing but they are also leading the way.

Still, there is considerable heterogeneity around the world (Europe is much more advanced and proactive than the Americas).

ESG Basics

So, why now?

Investors understood that ESG issues are material.

- Material: issues that can truly (adversely) impact performance.

Big three, BlackRock, Vanguard, and State Street Global Advisors are demanding more transparency on ESG issues.

- Investors pressure. Supply of capital mechanism.

ESG might have a return-risk premium.

- Investors see the potential for (long-term) profits in E&S projects. Not easy to see them in the short term though.

Regulation (increasing in several parts of the globe).

- Example: non-electric into electric cars in Europe (see Norway).

Norway

Norway

ESG Basics

On top of that, we have some important examples of E&S problems:

British Petroleum (2010)

- BP’s US Deepwater Horizon oil Spill in the Gulf of Mexico. Received a fine of billions to clean the spill (50+ billion).

Volkswagen (2015)

- Received a €6.7 Billion penalty for emission tests alterations plus costs to recall source.

Cambridge Analytica (2018)

- The company used personal information on Facebook users.

- Mark Zuckerberg went to congress

British Petroleum (2010)

Activity

In pairs, students must bring an example of a firm implementing an E or an S program.

We will discuss briefly these examples/programs.

Activity II

For the next class, I’d invite you to watch the following videos.

https://www.youtube.com/watch?v=gJJlknOp_0w.

https://edition.cnn.com/videos/business/2020/07/16/the-global-energy-challenge.cnnbusiness.

I hope you like this class!

Find me at:

https://eaesp.fgv.br/en/people/henrique-castro-martins

https://www.linkedin.com/in/henriquecastror/