library(PerformanceAnalytics)

library(yfR)

library(ggplot2)

library(dplyr)

library(tidyr)

library(ggthemes)

library(tidyquant)

library(roll)

start <-'2010-01-01'

end <-'2023-01-01'

freq_data <- "yearly"

df <- yf_collection_get("IBOV",

first_date = start,

last_date = end,

freq_data = freq_data)

stocks <- unique(df$ticker)

df <- df %>% select(ref_date)

for (i in 1:length(stocks)) {

data <- yf_get(tickers = stocks[[i]],

first_date = start,

last_date = end,

freq_data = freq_data)

data<-data[complete.cases(data),]

data<- data %>% select(ref_date, ret_closing_prices)

colnames(data) <- c("ref_date", stocks[[i]] )

df <- merge(df,data,by="ref_date")

}

df$ref_date <-NULL

cov<- cov(df)

ret<- as.vector(colMeans(df))

# Random numbers to create the frontier

set.seed(100)

int <- 10000

w<- data.frame((replicate(length(stocks),sample(int,rep=TRUE)) / int ))

w$sum <- rowSums(w)

colnames(w) <- c(stocks, 'Sum')

for (i in 1:int) {

w[i, 1:length(stocks)] <- w[i, 1:length(stocks)] / w[i, ncol(w)]

}

w$Sum <- NULL

w$Sum <- rowSums(w)

w$Sum <- NULL

# creating final dataframe

port <- data.frame(matrix(NA,nrow = int,ncol = 2))

colnames(port) <- c("Return", "Sd")

for (i in 1:int) {

port[i,1] <- sum( w[i, ] * ret )

port[i,2] <- sqrt( as.matrix(w[i, ]) %*% as.matrix(cov) %*% as.matrix(t(w[i, ]) ))

}

#ggplot

library(plotly)

p<-ggplot(port, aes(x=Sd, y=Return)) +

geom_point(alpha=0.2) +

theme_solarized() +

xlab("Standard deviation") + ylab("Expected Return") +

labs(title = paste(int , "random portfolios - All Ibov (2010-2023, Yearly returns)") )

ggplotly(p)ESG & Institutional Investment

Part 1

Henrique C. Martins

Introduction to G and Shareholder value

In this class, we will discuss the fundamental aspects of G and how they drive (or don’t drive) the implementation of E and S strategies.

We will discuss the firm, but keep in mind our focus here:

- the investors.

To understand how investors will face ESG strategies and how they could incorporate ESG into their portfolios, we need to understand the impact of E&S on the firm.

How to Calculate Present Value

Traditionally, we calculate a firm’s value using the following concept:

\[NPV = \sum_{t=1}^{\infty} \frac{FCF_t}{(1+WACC)^t}\]

A firm generates cash flow in the future.

These cash flows are discounted to the present at a given discount rate.

The result is: the present value of the sum of these future cash flows.

This is the best proxy we have for the value of a firm.

There is no novelty here. This has been done for a long time now.

The internal mechanics of how a firm generates value leads to the study of G.

G Pillar

G

There are some alternative definitions of G:

Corporate governance deals with the ways in which suppliers of finance to corporations assure themselves of getting a return on their investment.

Andrei Shleifer and Robert Vishny 1997

We define CG as the collection of control mechanisms that an organization adopts to prevent or dissuade potentially self-interest managers from engaging in activities detrimental to the welfare of shareholders and stakeholders.

Larcker and Tayan

G

You may find more recent definitions of G addressing S issues.

I find that troublesome because they bring social issues to the G conversation.

The modern solution is to have both S and G separated (as topics of discussion), but obviously interconnected in a firm.

G

When we talk about G:

Board of directors (independence, diversity, etc.)

Ownership structure (concentration, rights, etc.)

CEO compensation

Capital structure decisions (monitoring by creditors)

The investors’ protection laws

Regulations, Auditors, etc.

G

G

One well understood goal of G is to mitigate (or “control”) Agency Conflicts.

G

One well understood goal of G is to mitigate (or “control”) Agency Conflicts.

G

One well understood goal of G is to mitigate (or “control”) Agency Conflicts.

G

Agency conflicts exist when managers pursue (private) goals not shared with investors (outsiders).

- Managers: agents

- Investors: principal

Example: managers perhaps avoid working hard to do something that is beneficial to investors. Instead, they do less than they could.

G mechanisms try to prevent agency conflicts. They are not perfect, but they usually work well (except, when they don’t =p).

- Of course, there is heterogeneity at the country level of how well they work.

G

At the end of the day, G leads to:

Better financial and strategic decisions today, increasing future FCF.

More transparency, decreasing WACC (investors more willing to finance the firm’s investments).

\[NPV = \sum_{t=1}^{\infty} \frac{FCF_t}{(1+WACC)^t}\]

Portfolio management

Portfolio management

Let’s take a moment to see what is the maximization problem that an investor is trying to solve.

From an investor perspective, this is the maximization problem:

How to increase the return-risk ratio?

You can think in terms of the Sharpe ratio.

\[Sharpe\;ratio = \frac{E[R_p]-R_f}{Sd(R_p)}\]

Portfolio management

Portfolio management

Portfolio management

So you combine

- different assets…

- with different risk profiles…

- with different correlations between them…

- from different classes…

- from different countries…

- and etc.

Portfolio management

You have to be smart in the “differences” you select. There is a “protocol”.

- Different investors’ profiles, risk tolerance, time horizon, etc.

Portfolio management

Portfolio management

Portfolio management

Portfolio management

Portfolio management

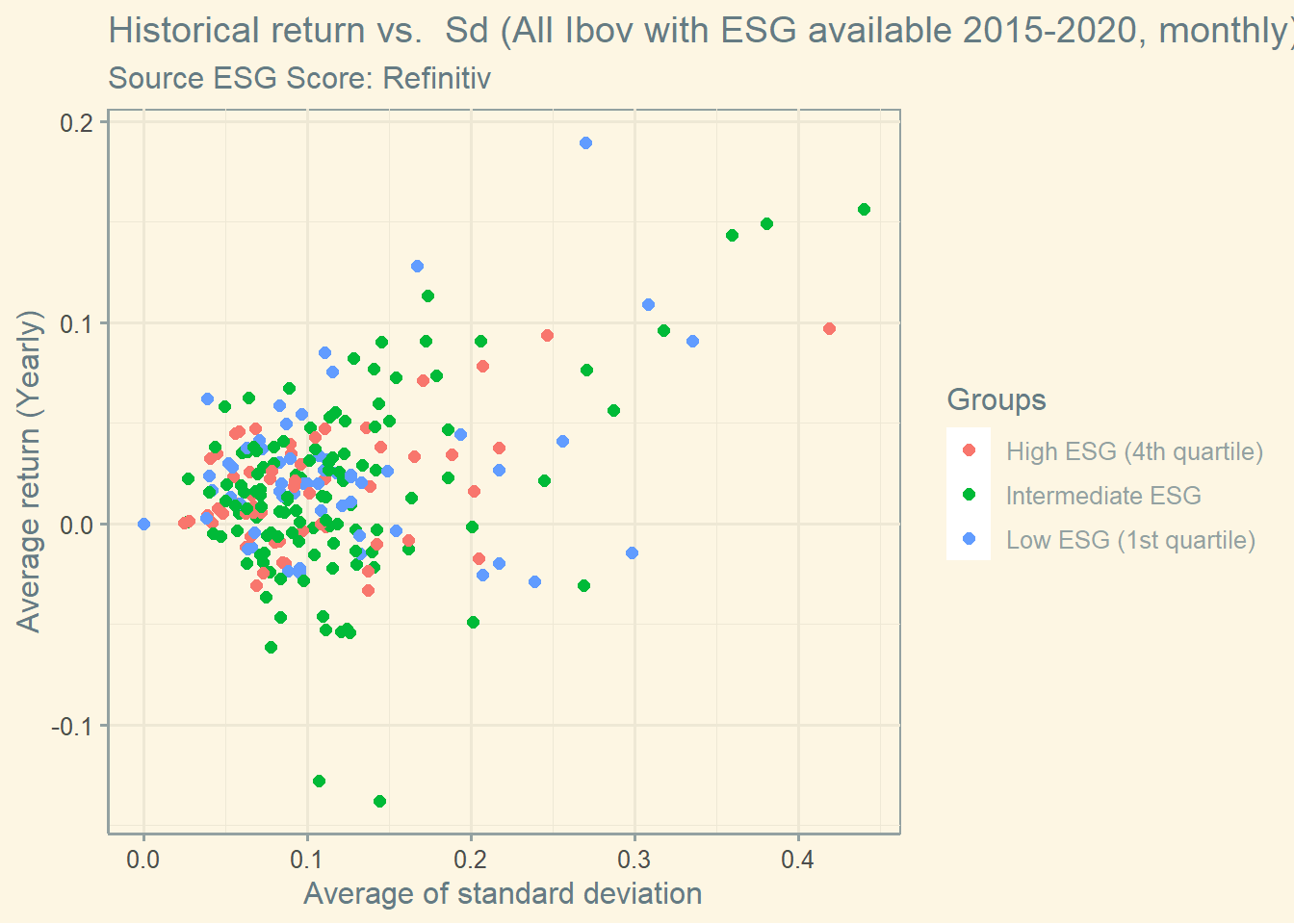

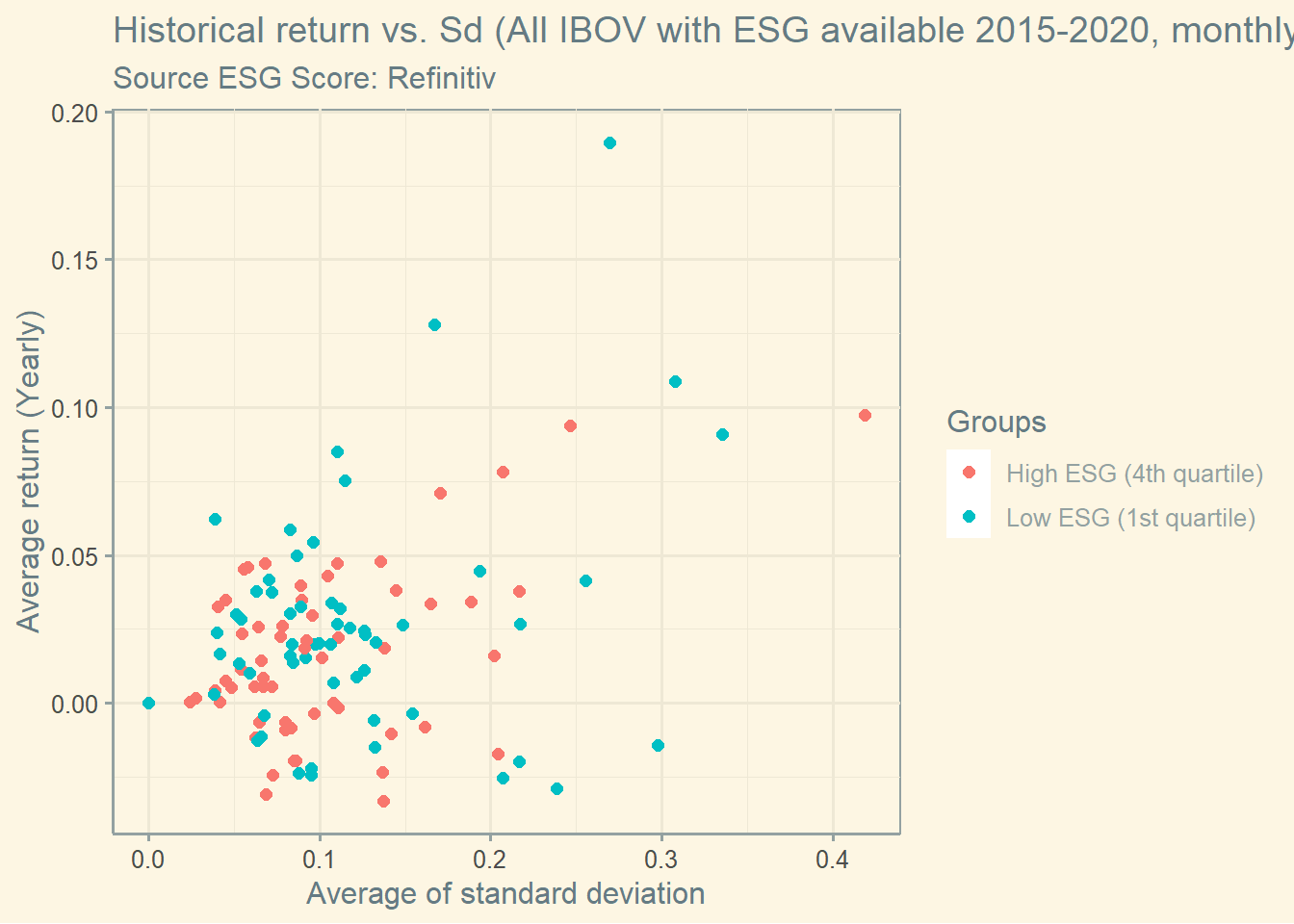

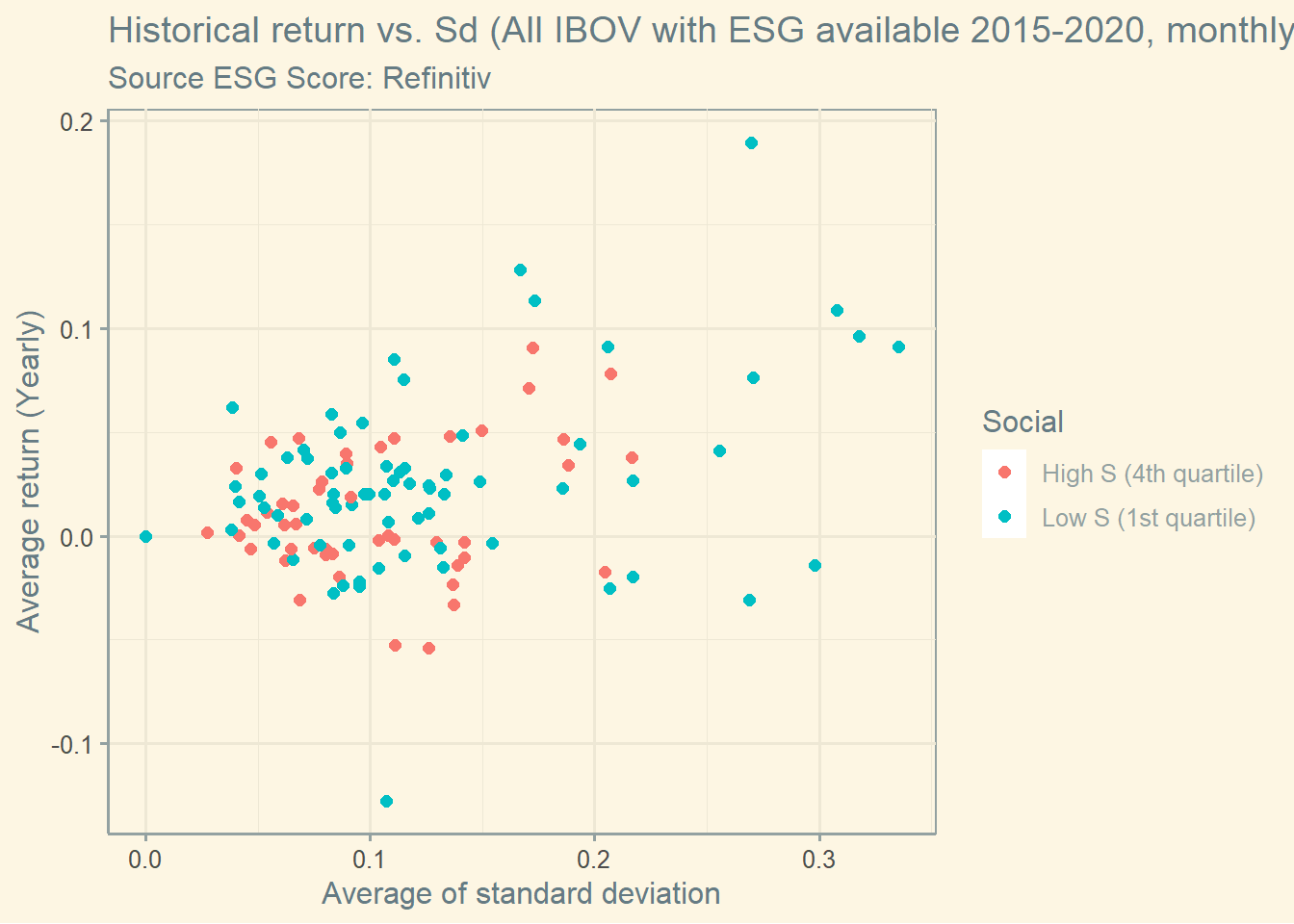

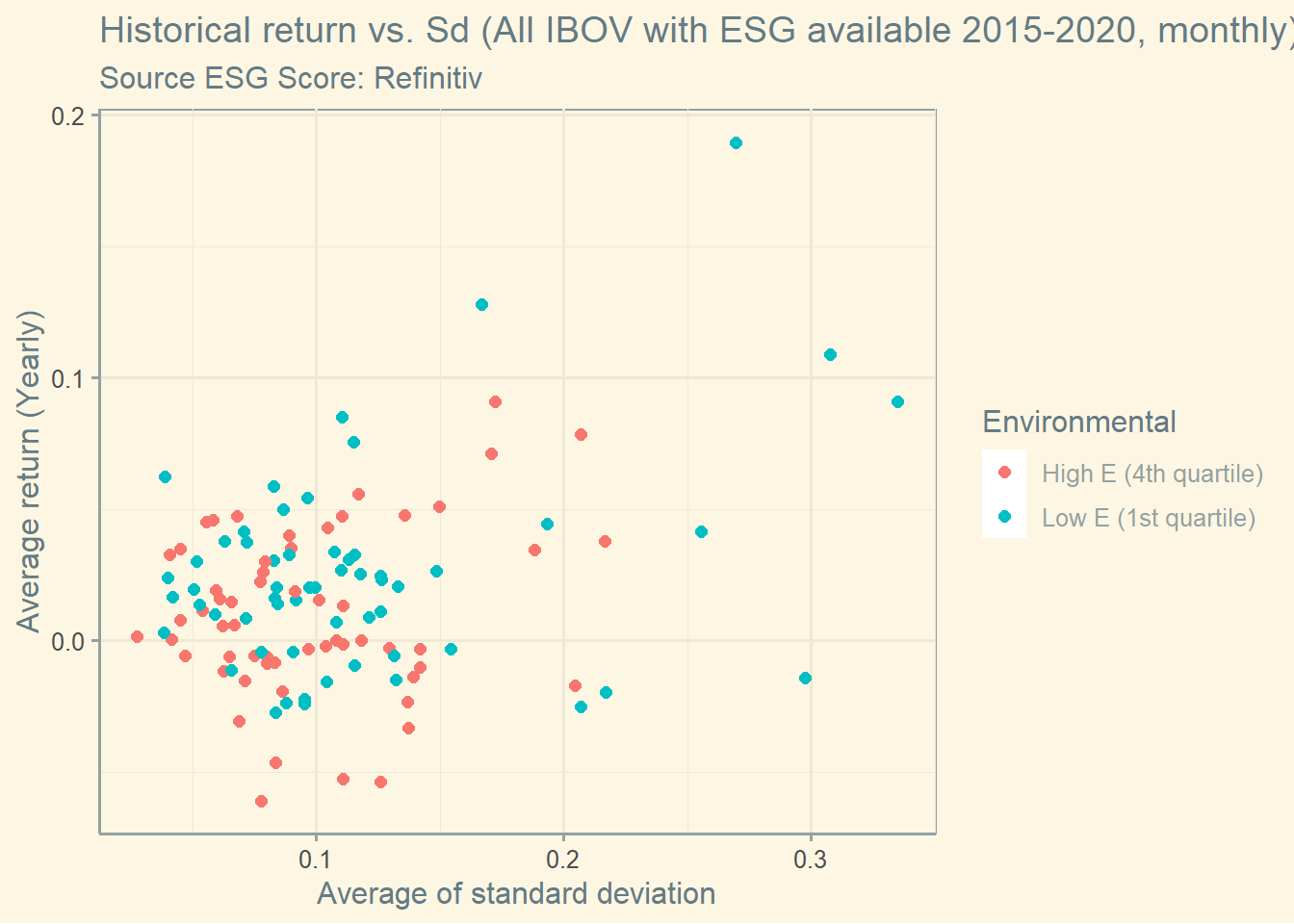

So, what is happening?

Are low-performance firms the ones investing in ESG, and maybe ESG brings their performance back?

Or does ESG not bring any performance at all?

Important: This is an aggregate, illustrative exercise.

I am not saying anything here, this is just data evidence, using Brazilian stocks and the Refinitiv Score.

- We will see later that this is not sufficient to reach a conclusion

It may vary in different locations, time periods, ESG scores, etc..

his is not an investment recommendation.

Portfolio management

One main question we will try to answer (but to be honest, not sure we can) is:

Does bringing E&S into the G conversation result in a better return-risk ratio?

The story here is perhaps more complex:

- There are some costs to invest in ESG practices, what are the cost-benefits of these practices?

- Perhaps firms with more resources to invest in ESG practices are more profitable (it is like a “pet project”)…

- But perhaps ESG is a form of differentiation, and therefore, firms that are less profitable may be investing in ESG to stay competitive in the modern market (it is like “running from the competition”).

Portfolio management

In this course, we will look at what investors are doing to maximize the return-risk ratio…

… while attending not only to traditional but also more modern demands from:

- Climate change problems

- Social movements

- Diversity

- Etc.

Portfolio management

What are the risks in ESG investing?

Asset devaluation risk: low ESG companies might lose value.

Regulatory risk: ES factors might become legal, so investors and companies need to follow the regulations.

Physical risk: climate-related tail events (e.g., extreme weather and record temperatures) can affect assets worldwide.

Litigation risk: especially, surrounding CO2 emissions. Companies might need to pay a penalty for high CO2 emissions.

Social movements risk: boycotts, refuse to buy, refuse to work, etc. can affect the demand for a company’s products and supply of workers

Portfolio management

What are the Opportunities in ESG investing?

Aligning with investors expectations and values

Maintain reputation

Higher valuation

Staying ahead, well-positioned to be in the future market

Efficiency & costs savings

Risk management

ESG Basics

ESG Basics

ESG is a framework that helps stakeholders understand and manage the risks and opportunities presented by the environmental, social, and governance factors.

- It has undergone significant evolution in recent years.

- Interestingly, the main drivers of this agenda are often investors, though it is also fair to say that society and government play a role.

Ultimately, all parties are interested in how the convergence of ESG factors create value and impact both the company and its stakeholders.

ESG Basics

Environmental: address a firm’s operations environmental impact and environmental stewardship.

- Climate Change and the environment

- “Clean” Energy & Energy transition

- Water management

- Ecosystems and biodiversity

- Pollution on seas

ESG Basics

Social: refers to how a firm manages relationships with and creates value for stakeholders

- Human rights

- Social conditions of work

- Labor practices

- Diversity, Equity, and Inclusion

- Stakeholder spillovers

ESG Basics

Governance: refers to a firm’s leadership and management philosophy, practices, policies, internal controls, and shareholders’ rights.

- Board of directors

- Executive compensation

- Transparency

- Anti-corruption

ESG Basics

There is no consensus about which dimensions should be incorporated

ESG Basics

Firms receive ESG scores (they are like ratings):

This is the methodology of Refinitiv (one provider, there are others).

There is no consensus about which dimensions should be incorporated

ESG Basics

One important caveat of ESG nowadays:

The theory is not well developed yet.

While you can argue for (and mathematically show) the benefits of the shareholder-maximization paradigm and about the G …

… you don’t have the same math rigor about the E and the S.

ESG Basics

But that is changing:

ESG Basics

ESG Basics

ESG Basics

ESG Basics

Key Insights:

Scholars are making attempts to bring ESG concepts into theory.

However, much of the current debate is driven by personal opinions and subjective arguments.

This article seems to suggest that investors may be willing to accept lower Sharpe ratios from high ESG companies.

The article introduces the concept of a three-way optimization (return, risk, ESG) rather than just return and risk.

- The objective is to optimize both the Sharpe Ratio and ESG considerations.

So, why now?

So, why now?

- ESG has gained recognition among investors as being a critical factor in making investment decisions

The big three investors, BlackRock, Vanguard, and State Street Global Advisors, are taking a lead role in driving the ESG agenda forward and putting pressure on companies to disclose more information.

- Investors pressure. Supply of capital mechanism.

ESG might have a return-risk premium.

- Investors see the potential for (long-term) profits in E&S projects. Not easy to see them in the short term though.

Regulation (increasing in several parts of the globe).

- Example: non-electric into electric cars in Europe (see Norway).

So, why now?

The 17 SDGs from The United Nations.

So, why now?

So, why now?

So, why now?

On top of that, we have some important examples of E&S problems:

British Petroleum (2010)

- BP’s US Deepwater Horizon oil Spill in the Gulf of Mexico. Received a fine of billions to clean the spill (50+ billion).

Volkswagen (2015)

- Received a €6.7 Billion penalty for emission tests alterations plus costs to recall source.

Cambridge Analytica (2018)

- The company used personal information on Facebook users.

- Mark Zuckerberg went to congress

So, why now?

British Petroleum (2010)

Activities

Activity I

In pairs, you must bring an example of a firm implementing an E or an S program.

Also, have a look at the G of this company.

We will discuss briefly these examples/programs.

Activity II

For the next class, I’d invite you to watch the following videos.

THANK YOU!